Glory Info About Petty Cash Expenses Format

![40 Petty Cash Log Templates & Forms [Excel, PDF, Word] ᐅ TemplateLab](https://templatelab.com/wp-content/uploads/2017/08/petty-cash-log-06.jpg?w=395)

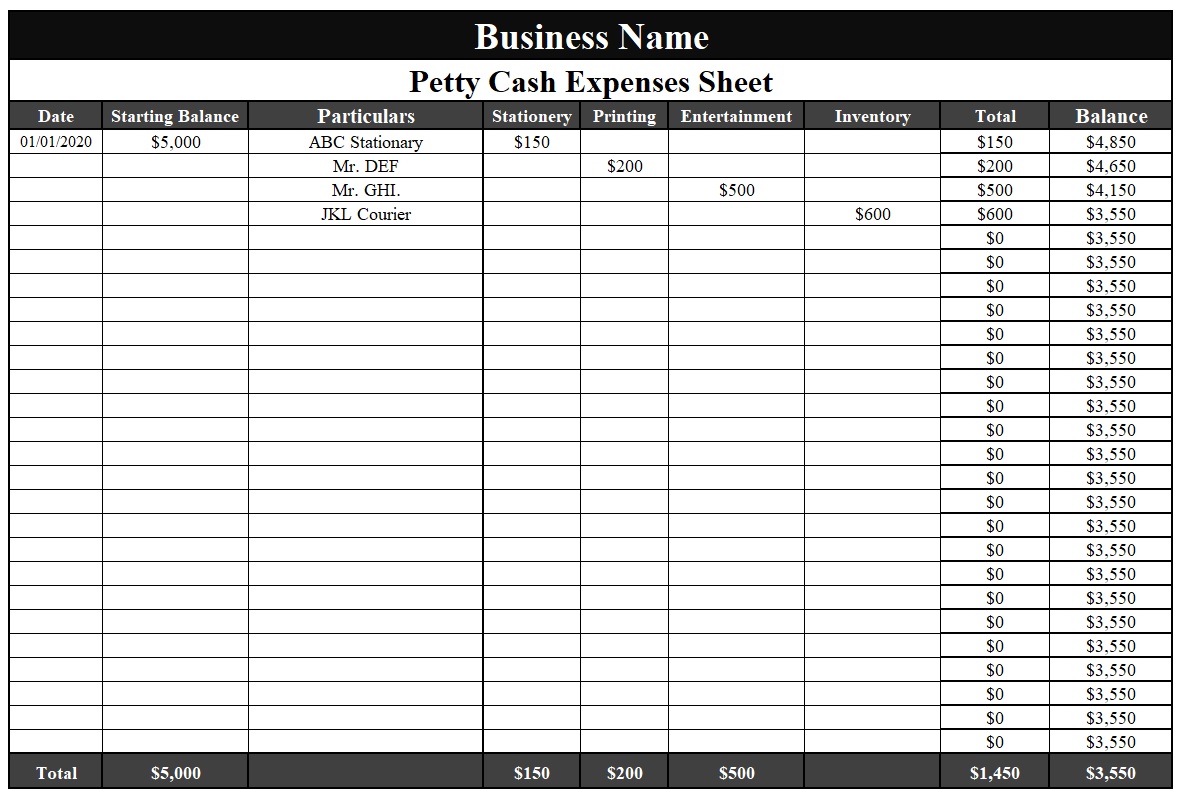

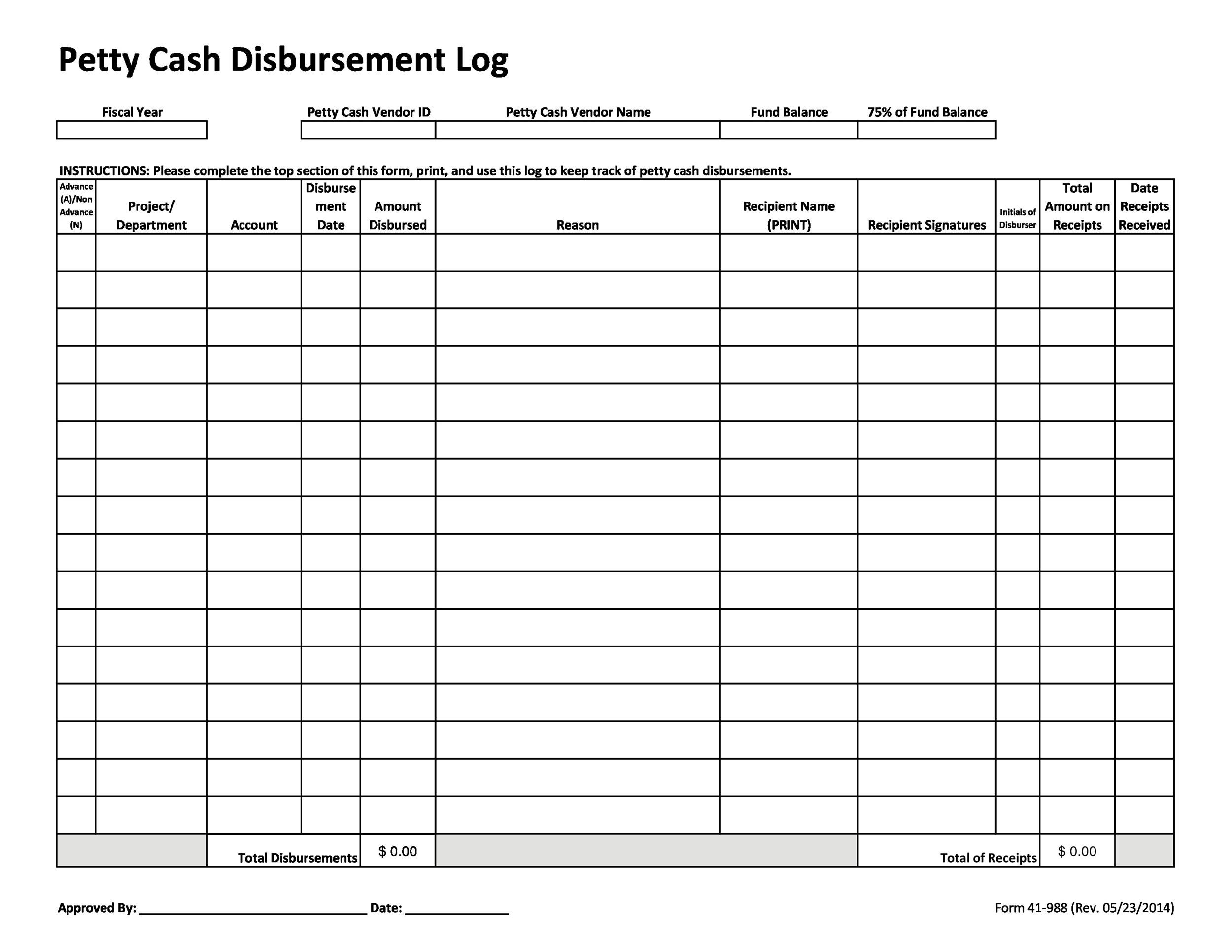

Format of petty cash book.

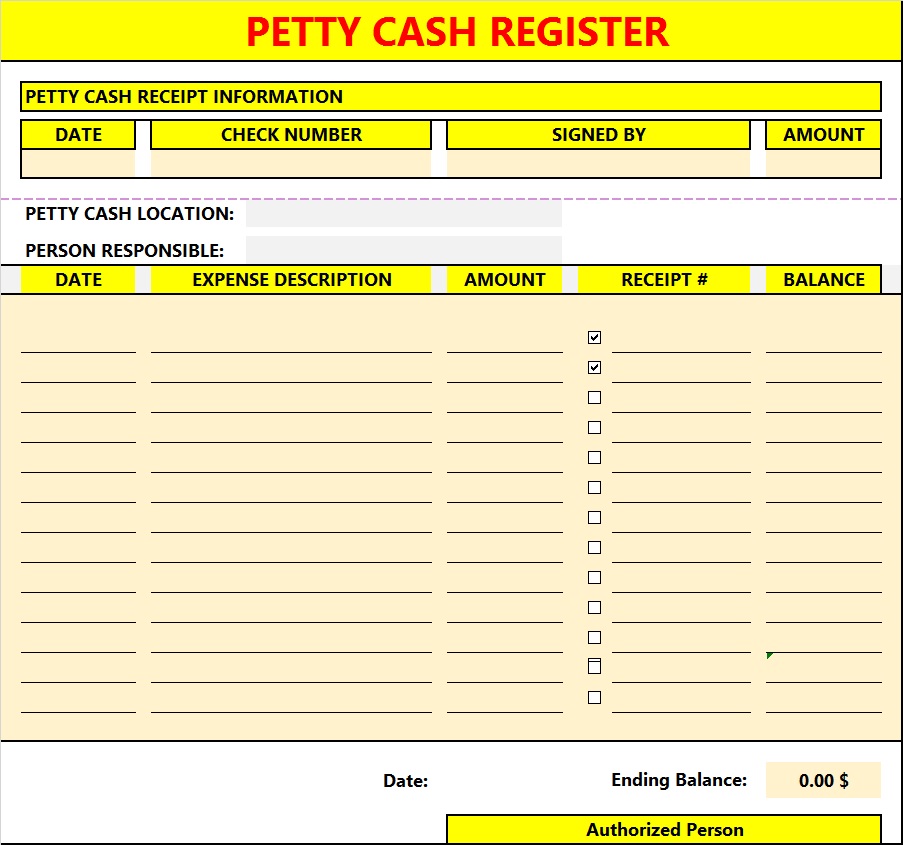

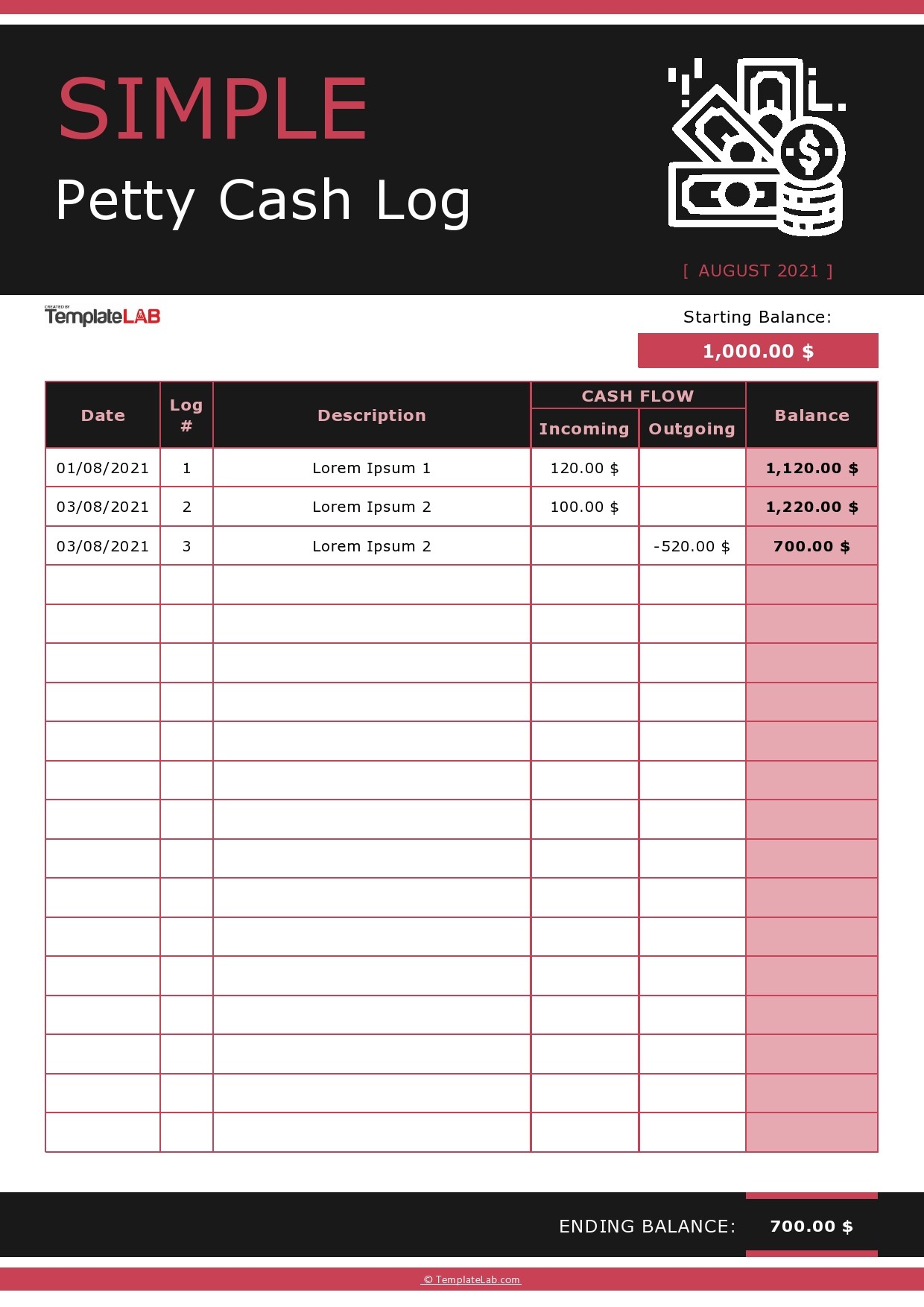

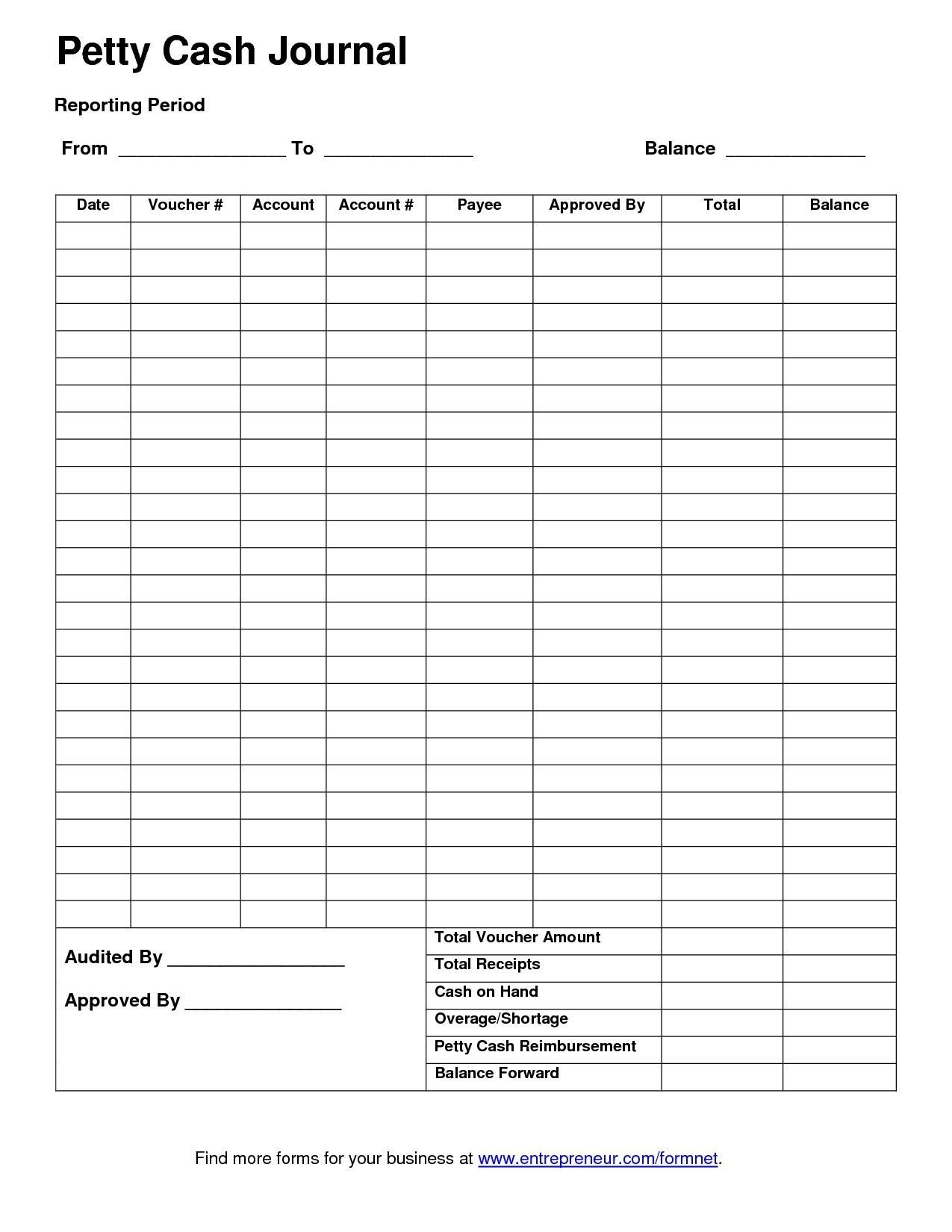

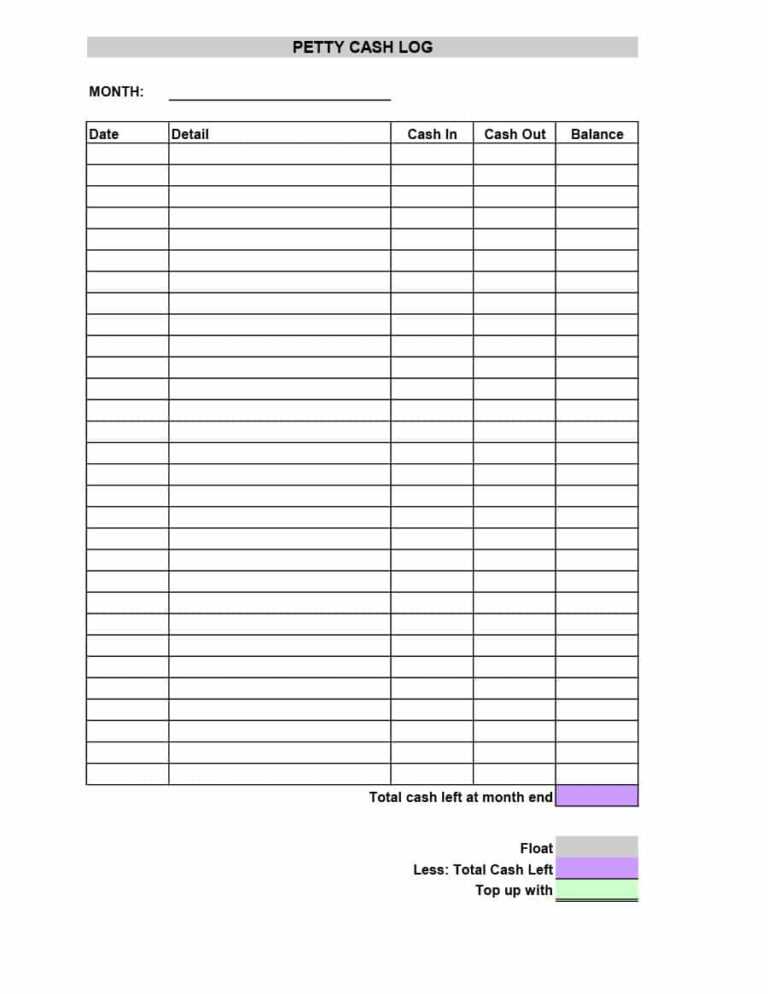

Petty cash expenses format. Accounting’s core lies in the journal, ledger, and petty cash book. Get a lockbox or cash register you can find these at most office supply stores. Meaning and definition a simple type of petty cash book is one that is maintained simply with the help of 2 primary columns, one for receipts (left) and one for payments (right).

A petty cash fund is often used to cover small or. A simple format of petty cash book is given below: Petty cash is also the title of a current asset account on the general ledger that reports the company’s petty cash amount.

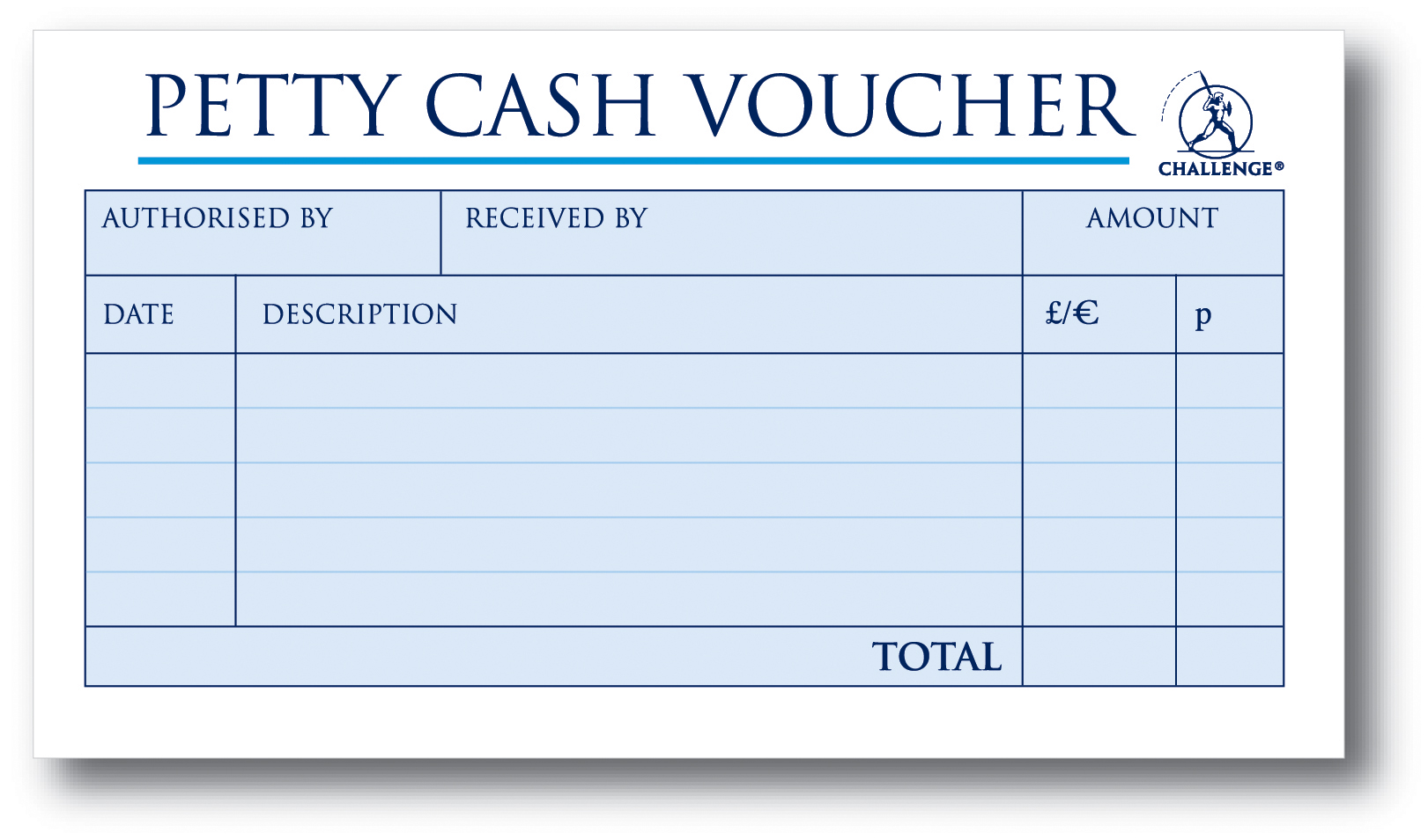

Throughout the day, quite a number of petty expenses are done especially for bigger organizations and having a book to record everything in is essential so you don’t lose track of your money and you don’t end up having questions about daily expenditures. These vouchers help in tracking money taken from the fund, which is. The petty cash custodian lets the cash balance in the petty cash box decline to $20 before applying for replenishment.

Most transactions in the petty cash book are recorded in the cash account. That is why a petty cash fund is created to handle petty expenses. If you want to customize a form, you can download the.

Description this printable pdf provides a simple way to keep track of your petty cash with a printable form. A petty cash book is maintained to record small expenses such as postage, stationery, and telegrams. Without a physical, dedicated place to keep the petty cash, you’ll probably lose track of.

Learn how to manage a petty cash fund. Petty cash book: Learn about petty expenses, what is a petty cash book, petty cash book format, types of petty cash books, and much more.

What is a petty cash book? Petty cash is cash that businesses keep on hand for small purchases. Create a header first, create a header for the balance sheet along with the company logo as shown below.

Business 20 petty cash log templates & forms (word, excel, pdf) every business manager knows the key to improving a company’s bottom line is efficient asset control. Add summary row then, add a. The petty cashier of john and james company paid cash for the.

Depending on the company, there may. When your organization has an actual book for petty expenses, all. A separate column is used for.

There are two systems to record.

![40 Petty Cash Log Templates & Forms [Excel, PDF, Word] Template Lab](http://templatelab.com/wp-content/uploads/2017/08/petty-cash-log-05.jpg)

![40 Petty Cash Log Templates & Forms [Excel, PDF, Word] ᐅ TemplateLab](https://templatelab.com/wp-content/uploads/2017/08/petty-cash-log-28.jpg)

![40 Petty Cash Log Templates & Forms [Excel, PDF, Word] ᐅ TemplateLab](https://templatelab.com/wp-content/uploads/2017/08/petty-cash-log-07.jpg?w=790)