Favorite Info About Stock Valuation Spreadsheet

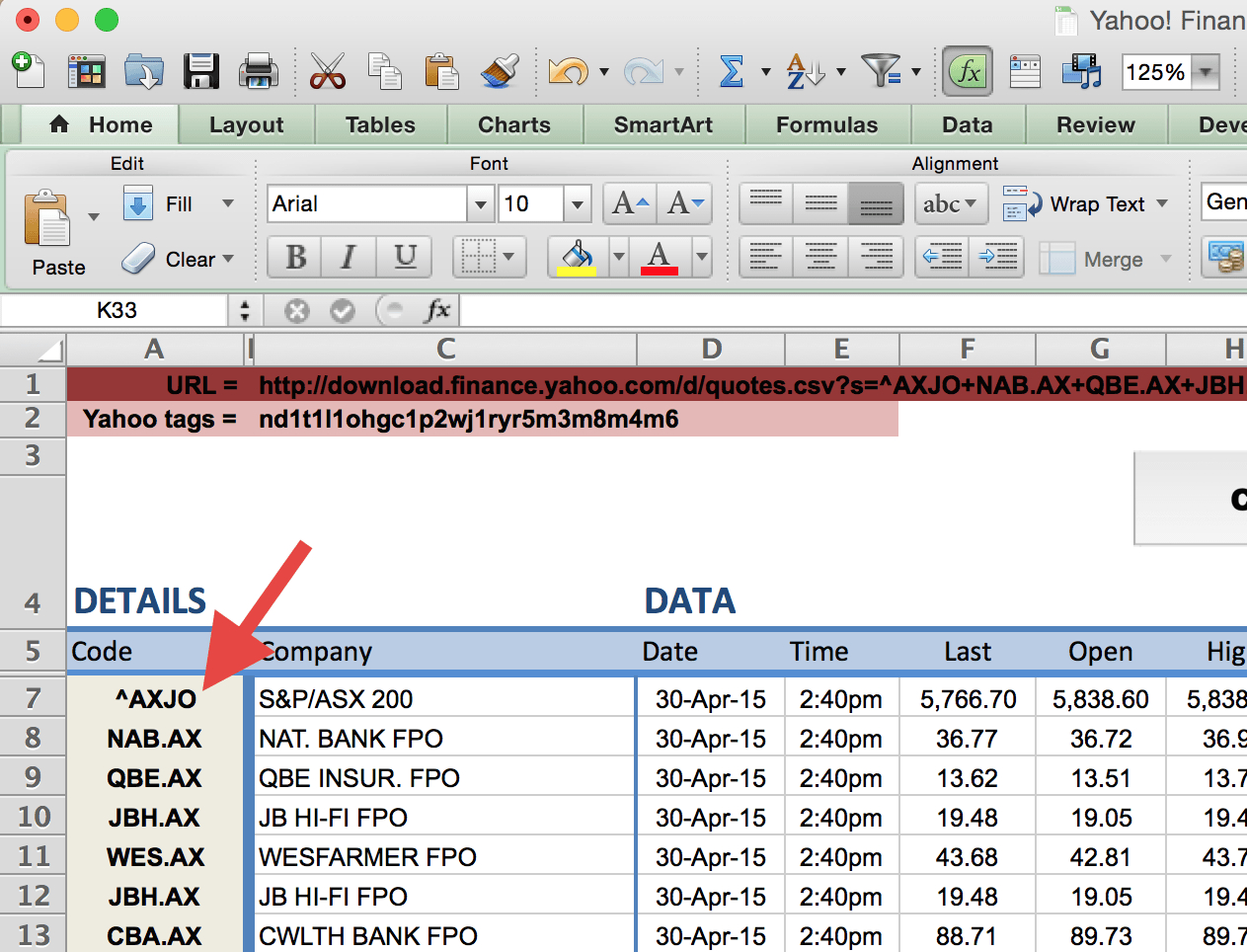

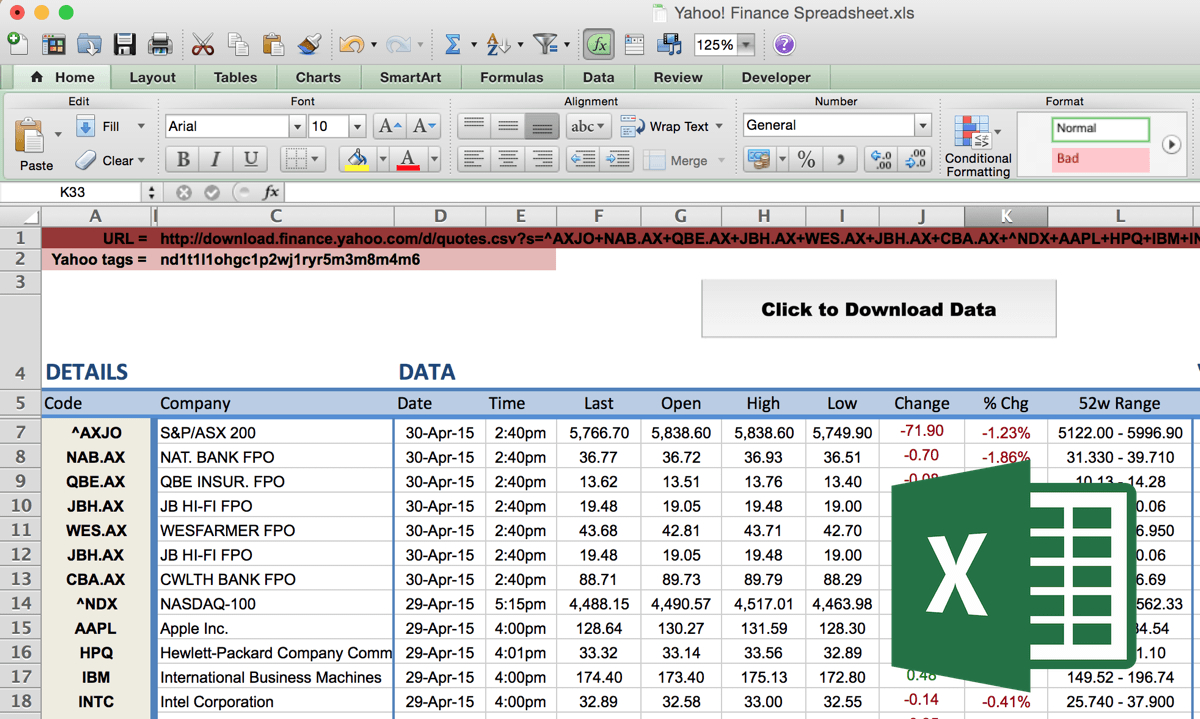

Download a free excel stock analysis template to find valuable investment opportunities for your portfolio.

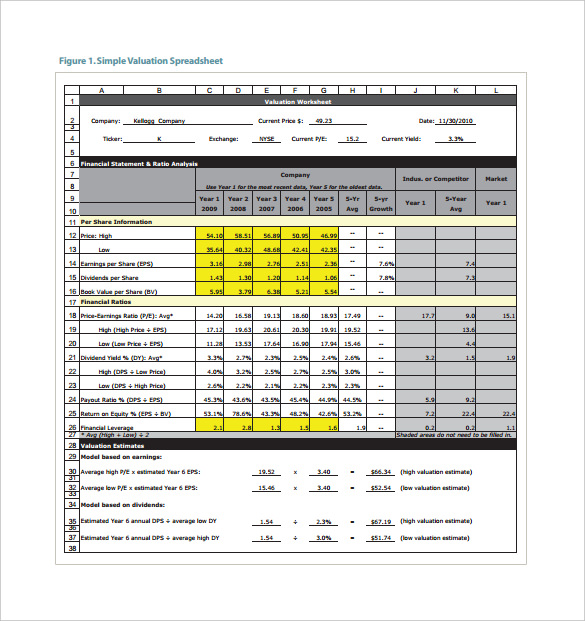

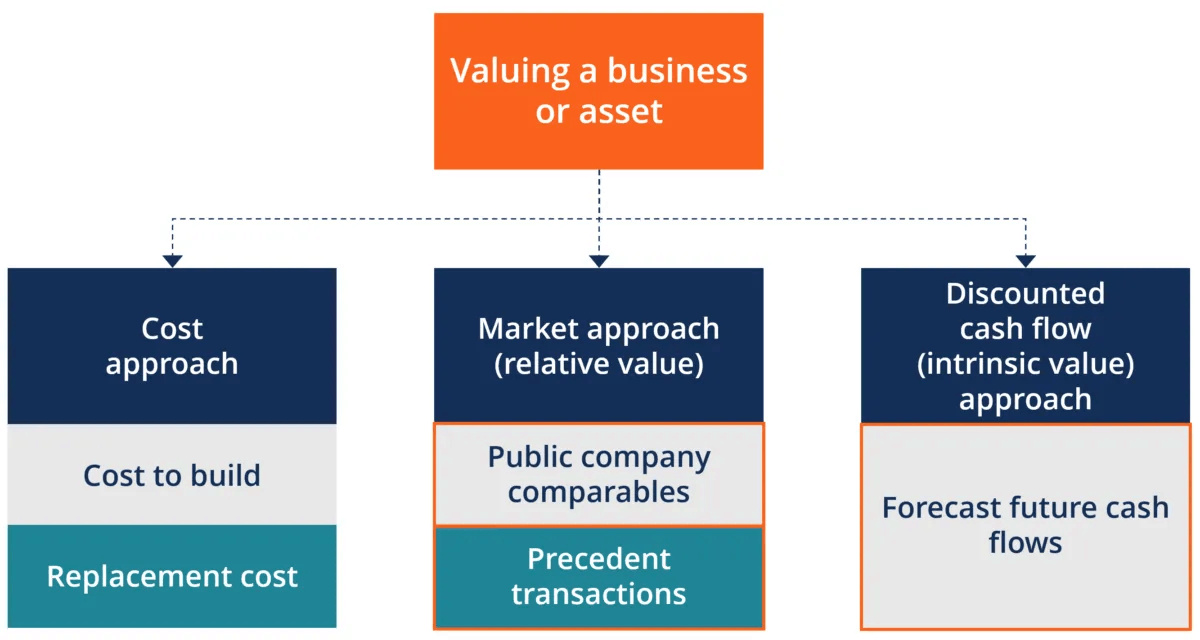

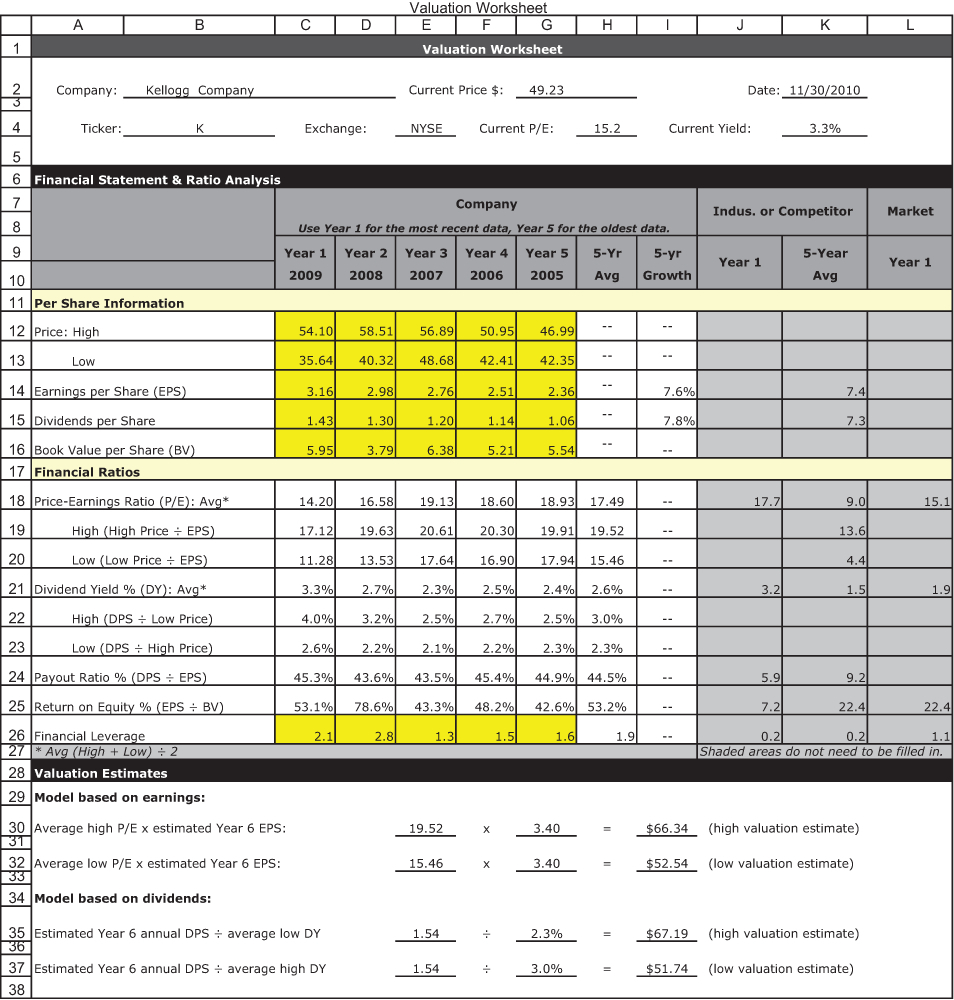

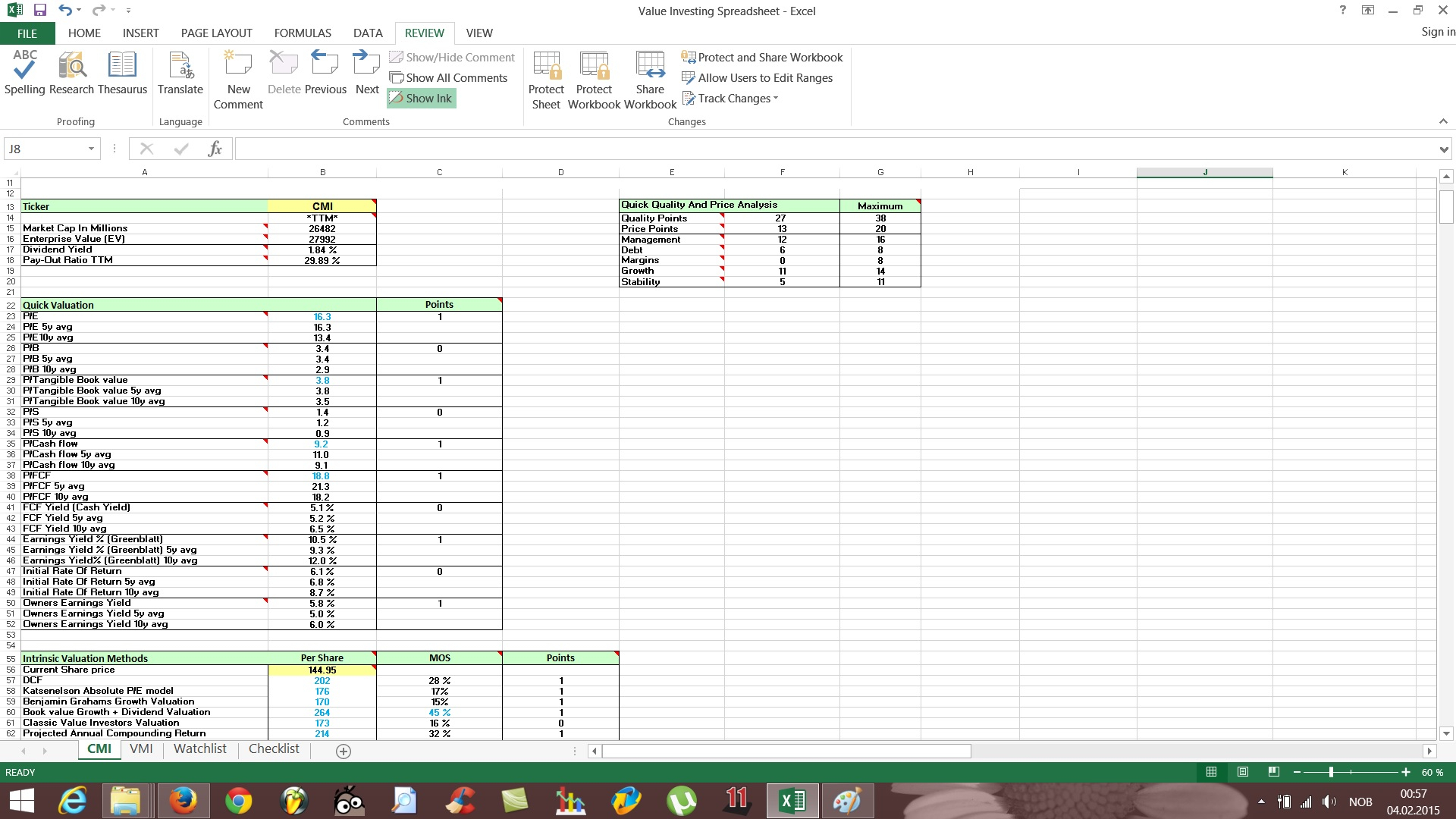

Stock valuation spreadsheet. | updated on february 3, 2024 a valuation spreadsheet is a model of a company’s future performance. Because of this, i created the. Below is a description of how to perform each type of modeling.

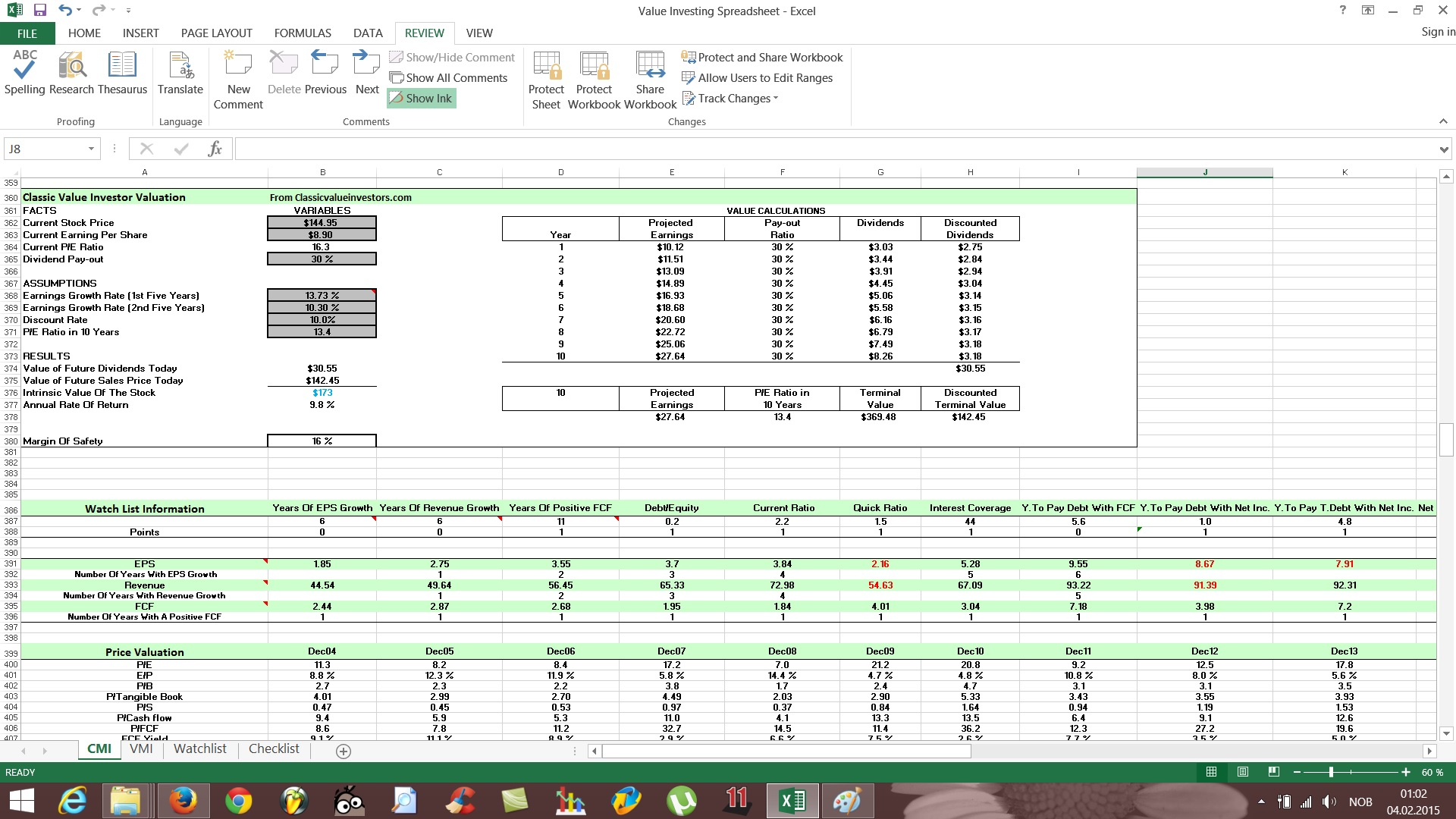

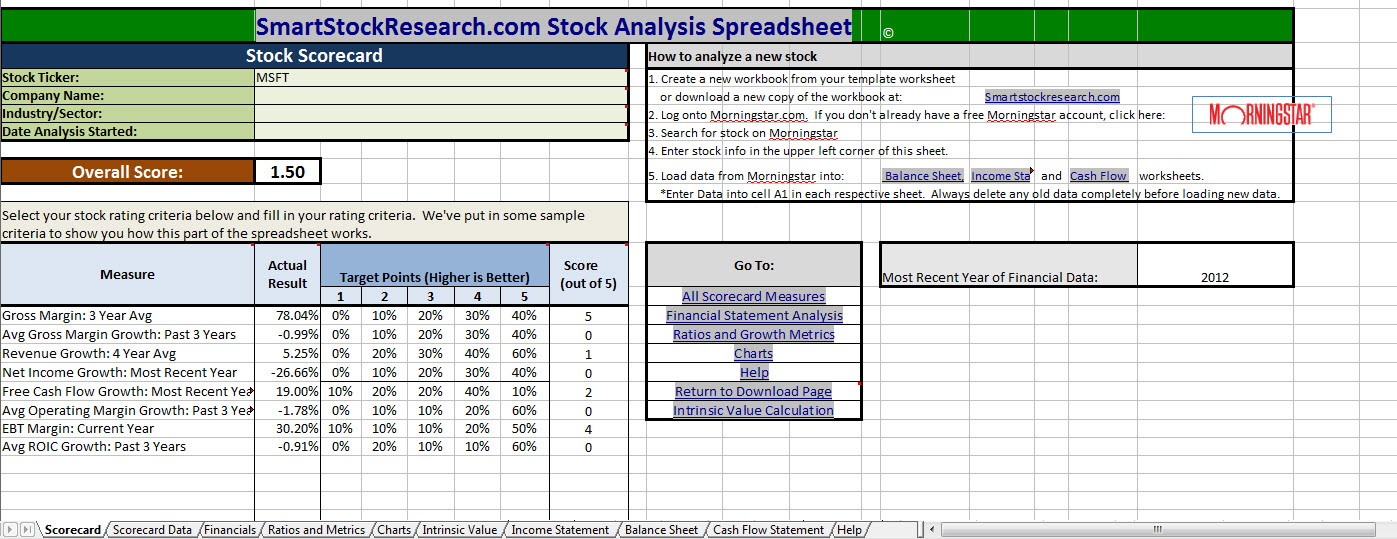

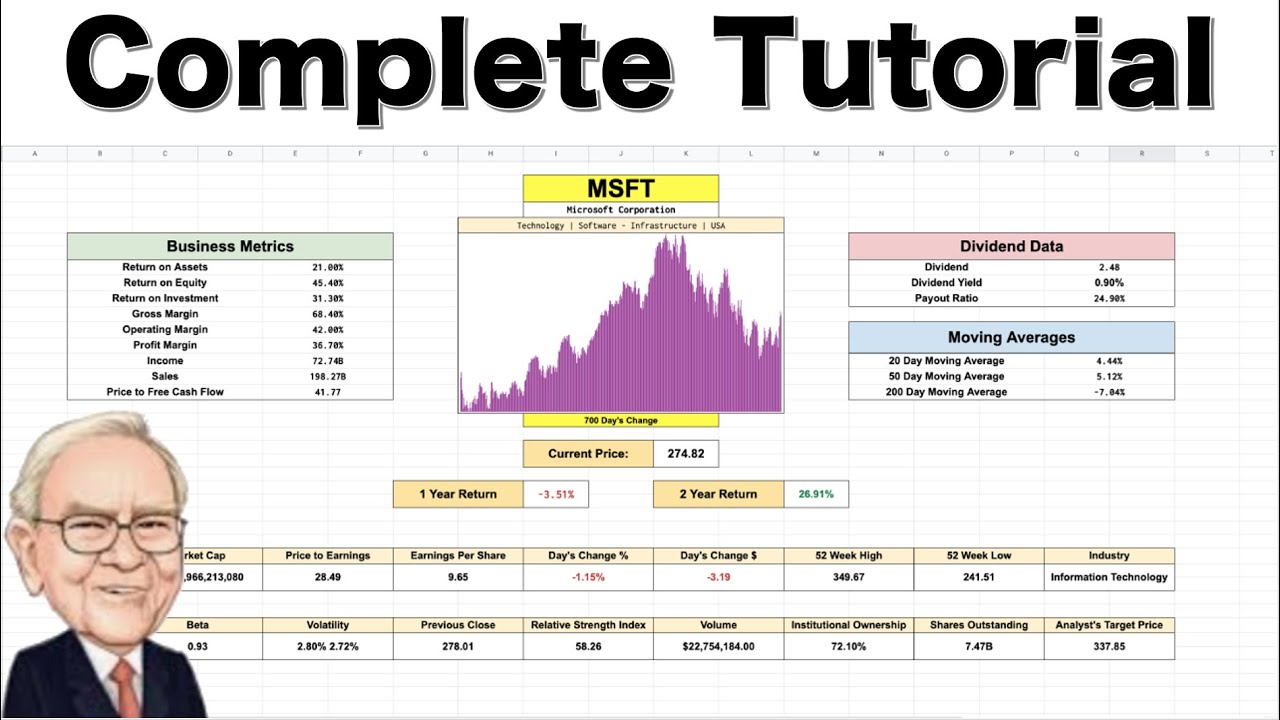

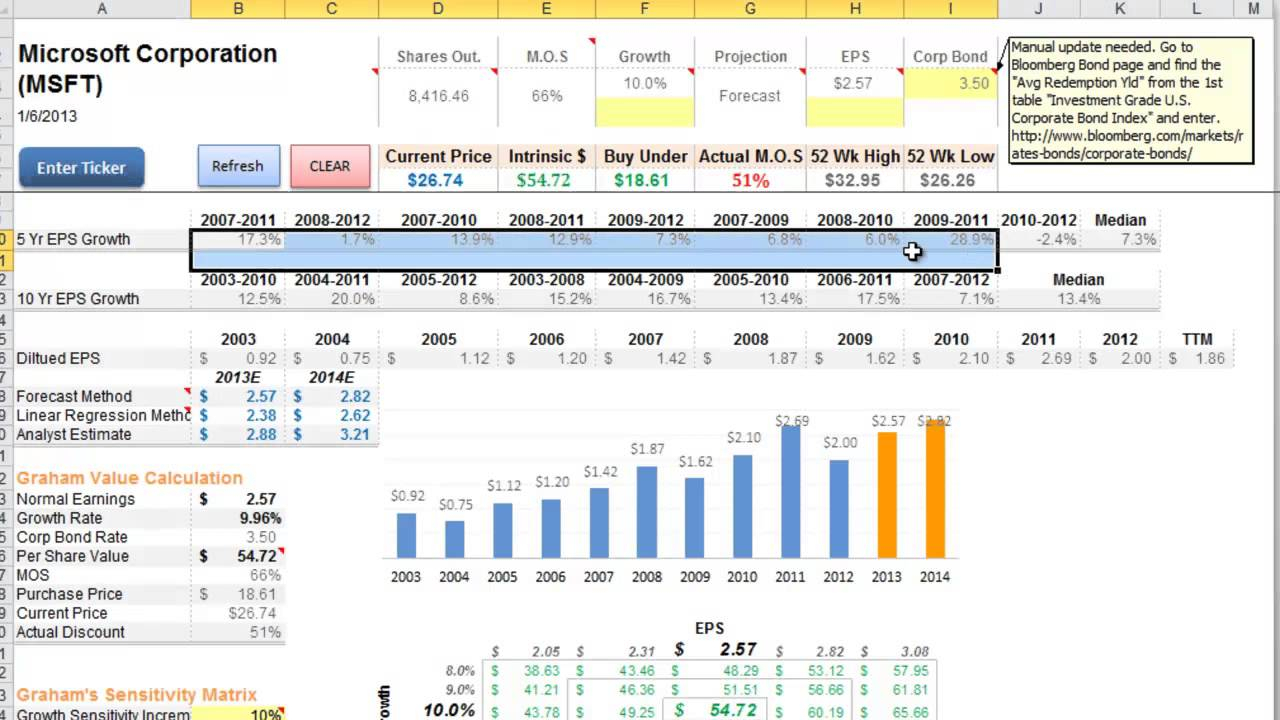

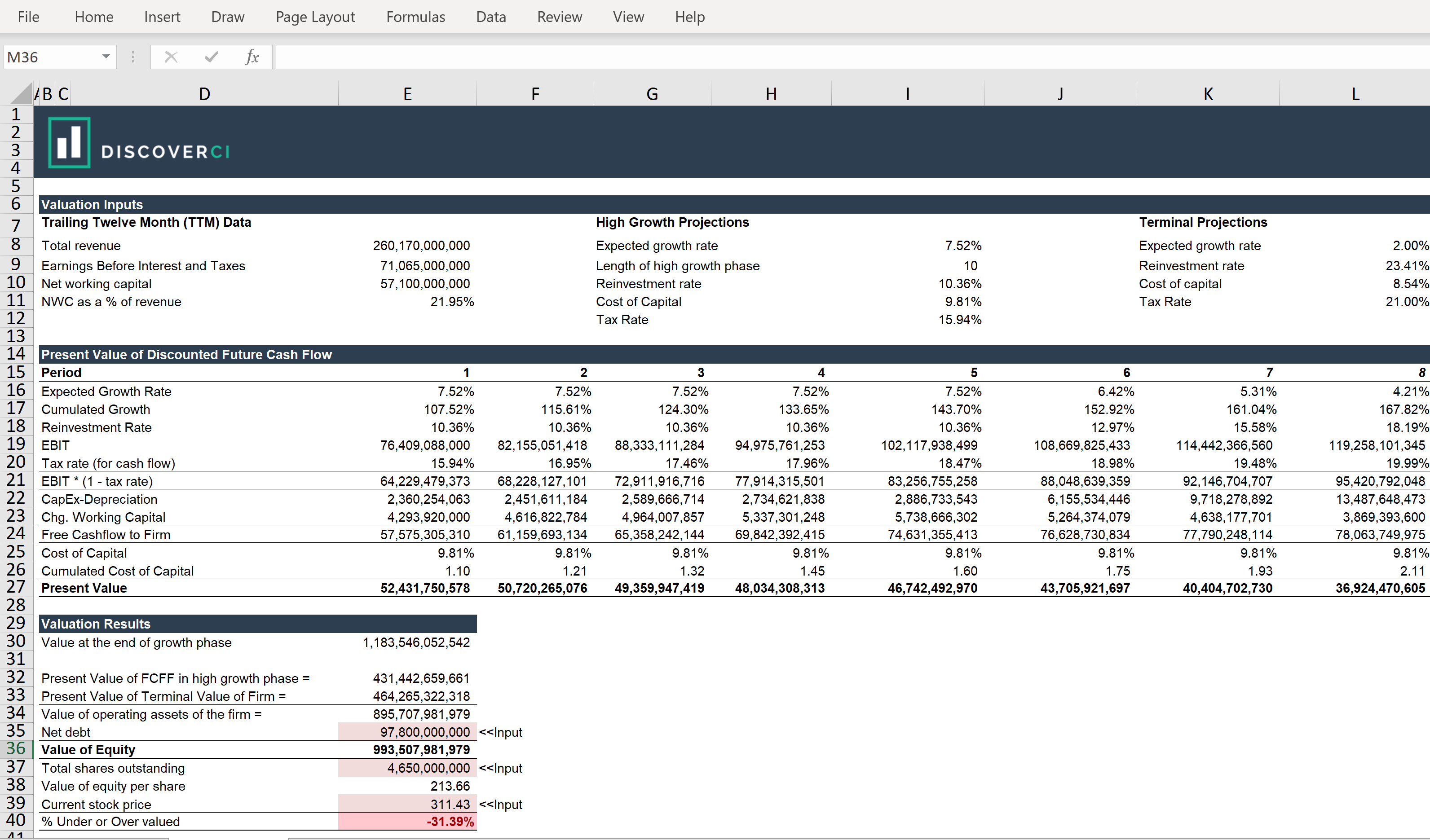

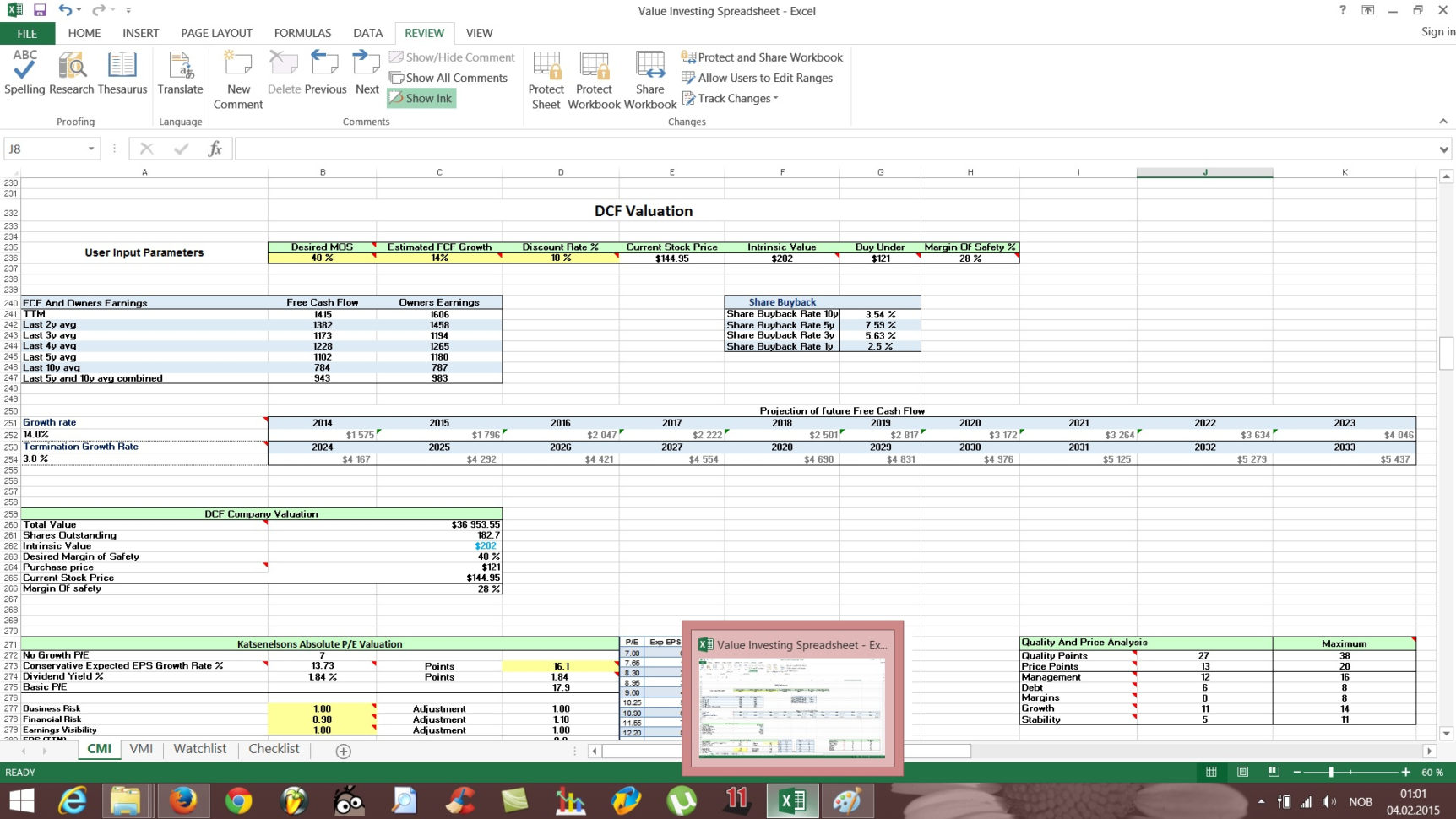

#1 discounted cash flow modeling in excel The excel stock analyzer now has two spreadsheets based on warren buffett’s approach to stock valuation. And….perform technical and fundamental analysis in order to find which stocks are a better value today, and which are better to avoid.

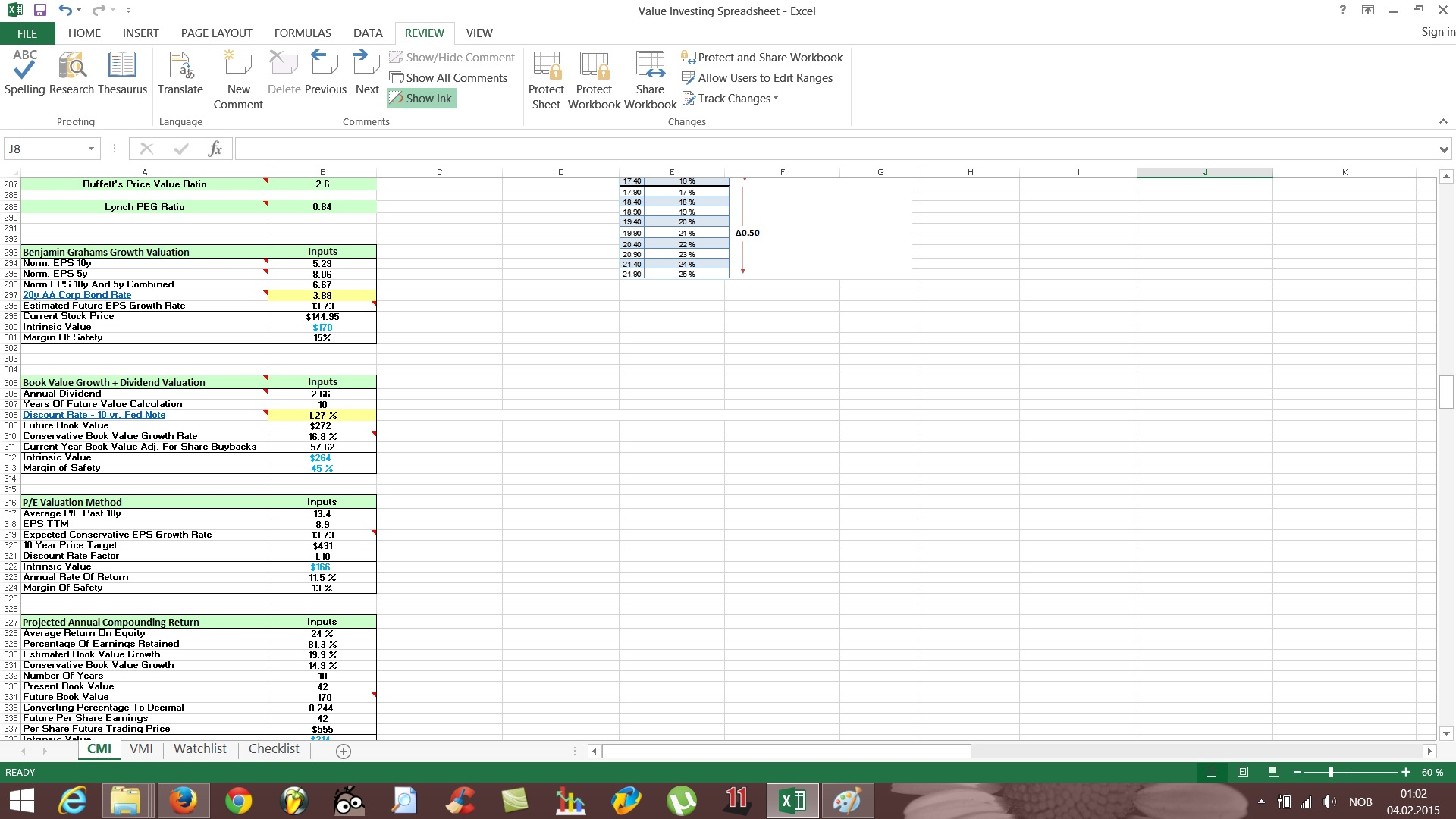

With this information, you can formulate an opinion as to whether a. Ben graham valuation model is a simple and straightforward model used by investors to calculate the intrinsic value of a stock using fundamental analysis. The valuation sheets have been built from the ground up based on this article:

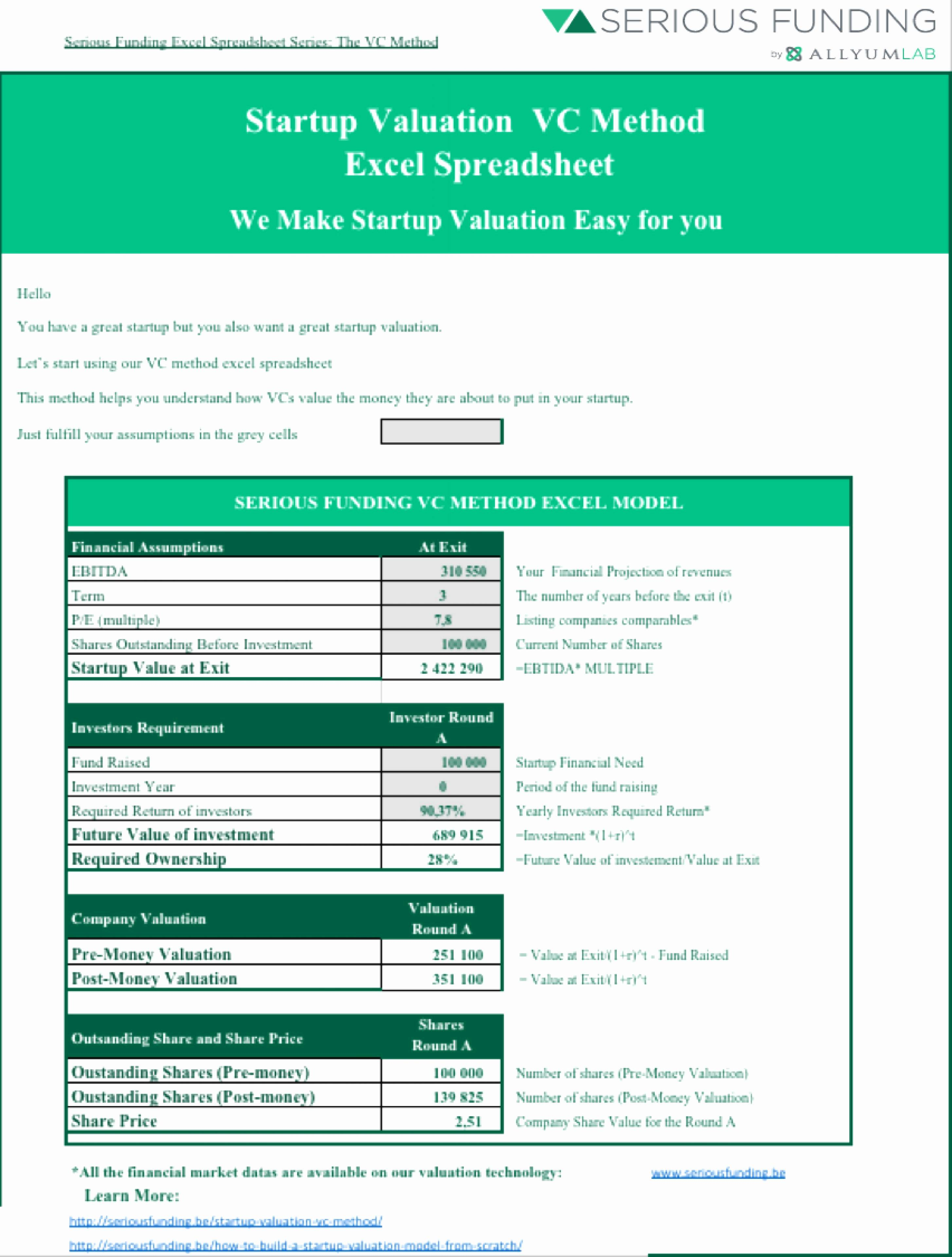

Finance strategy startups legal marketing leadership & hr technology student other stock valuation models start the discussion! Types of stock analysis spreadsheets a guide on the best stock analysis spreadsheets for comparing stocks, tracking your portfolio, and getting dividend data. The model is simple in theory but have various scenarios due to the different ways that dividends could be paid out.

The dcf template is an excel spreadsheet that allows you to input data and perform calculations to determine the intrinsic value of a stock. The dcf template for stocks in google sheets is a great way to quickly estimate the value of a stock using assumptions about future cash flows, discount rates, and other relevant metrics. / dividendology i am a huge believer in the fact that calculating intrinsic value is the best way to value a stock.

Download excel demo sheet. By simply changing the company along with different assumptions, you can. Last updated on june 3, 2022 at 11:16 pm.

Valuing a stock requires the right data, and the right valuation model. Consequently, it is useful in valuing warrants and management options. This is a model for valuing options that result in dilution of the underlying stock.

The basics behind stock valuation all businesses have an intrinsic value, and this value is based on the extent of free cash flow they have available during their lifetime. Price of stock with zero growth dividends; Stock valuation excel spreadsheet using dividend discount model.

Intrinsic value of the company is calculated using a. The template uses the discounted cash flow (dcf) method, which discounts future cash flows back to present value. To get started, set up the following in an excel spreadsheet:

It can also be a more convenient way to perform valuation analysis when spreadsheets are the only tool available for data collection. How to perform valuation modeling in excel? Valuing stocks is an art and a science because there are many factors to consider, such as a company's financial statements, its competitive advantages, and the overall health of the stock market.