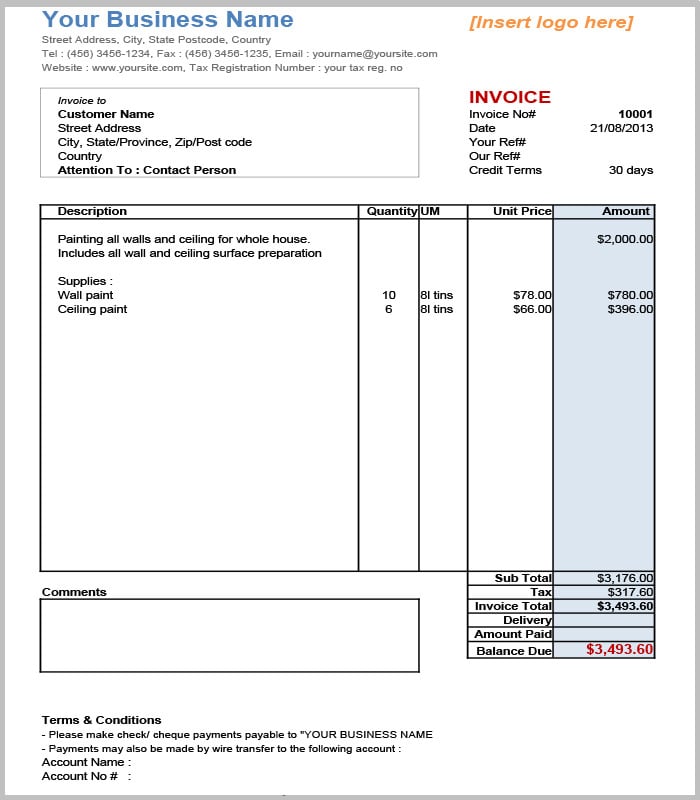

Awe-Inspiring Examples Of Tips About Tax Provision Template Excel

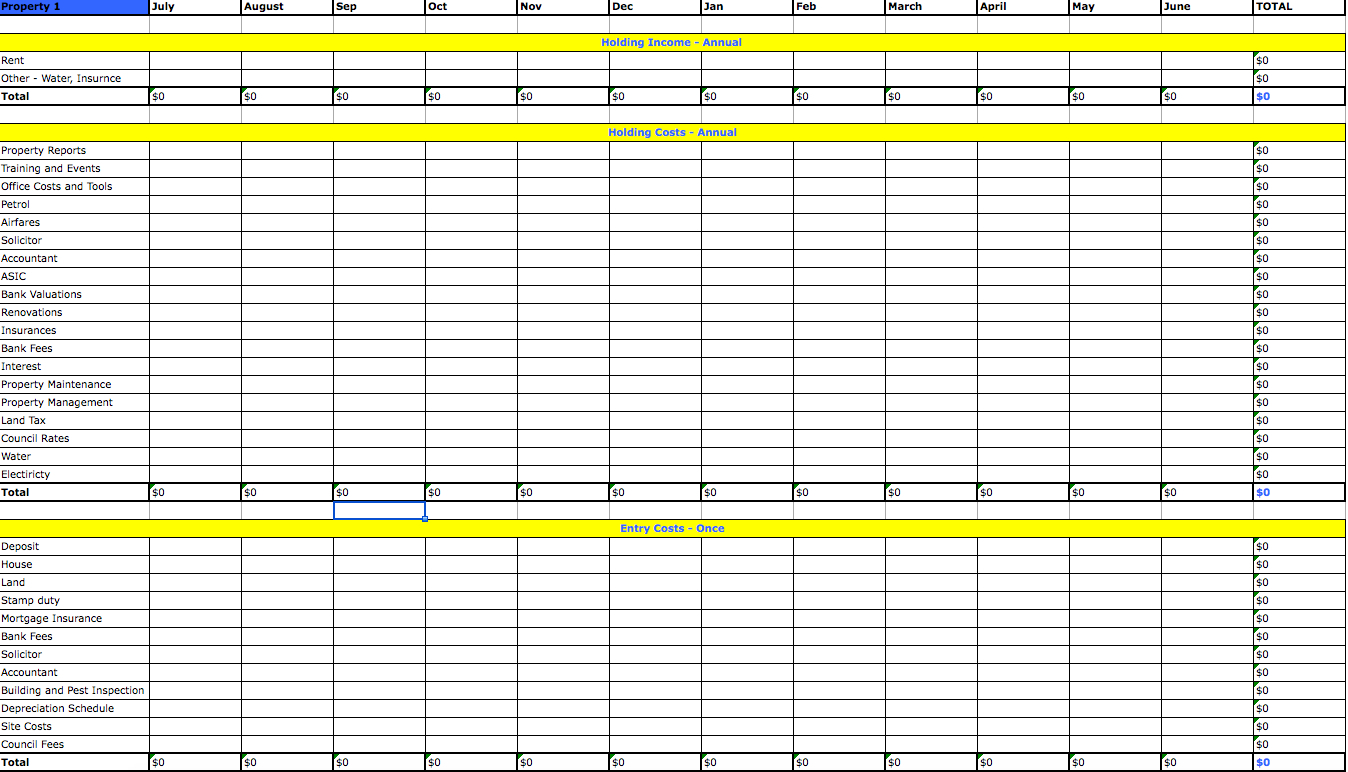

These tax template spreadsheets just help you on the way.

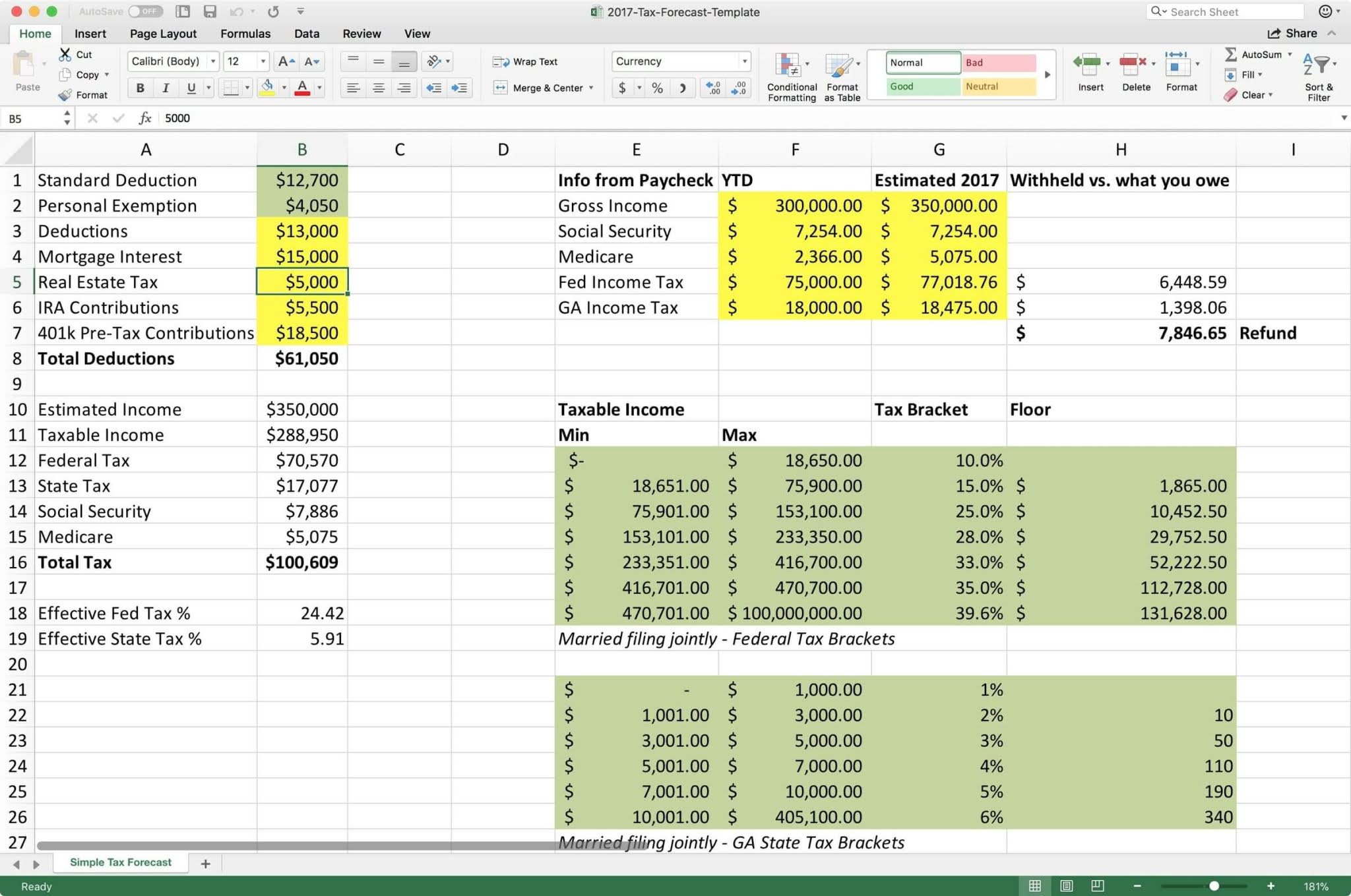

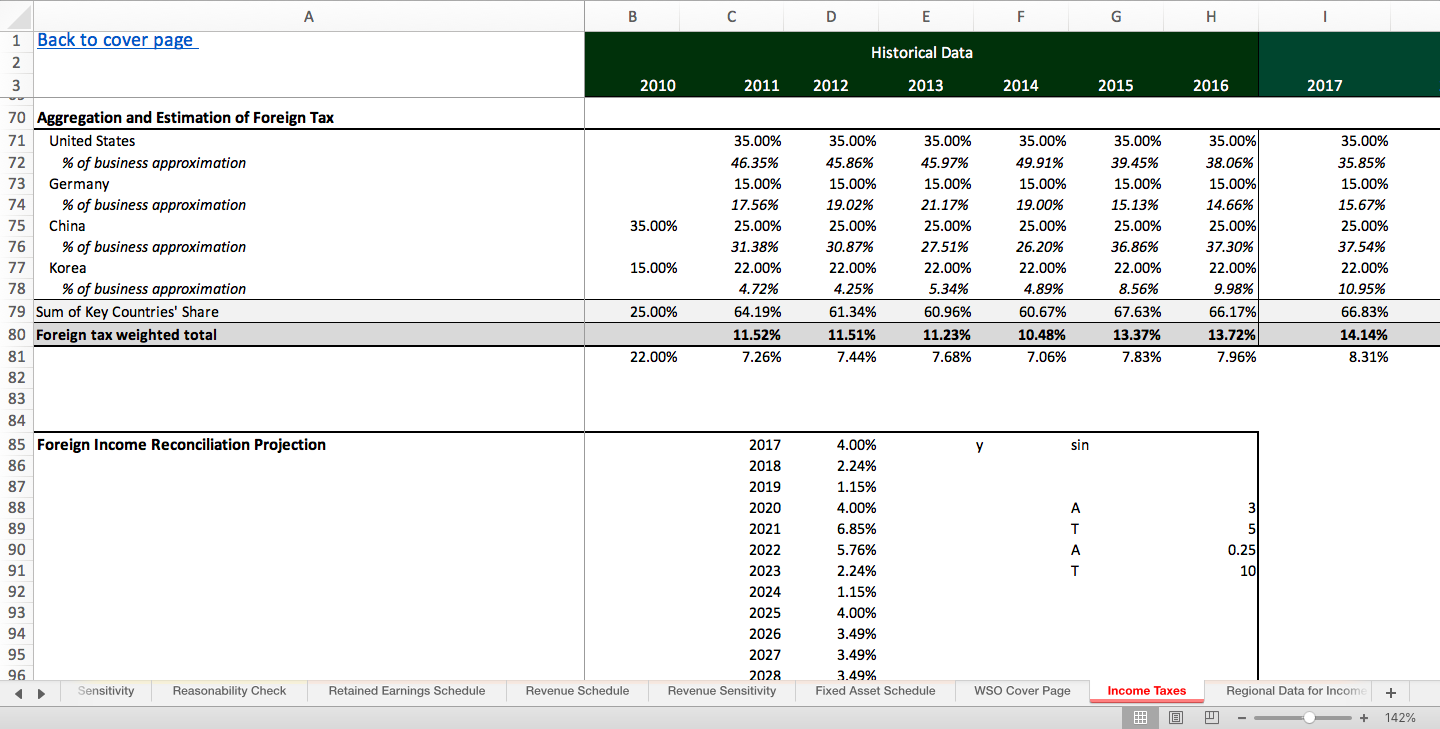

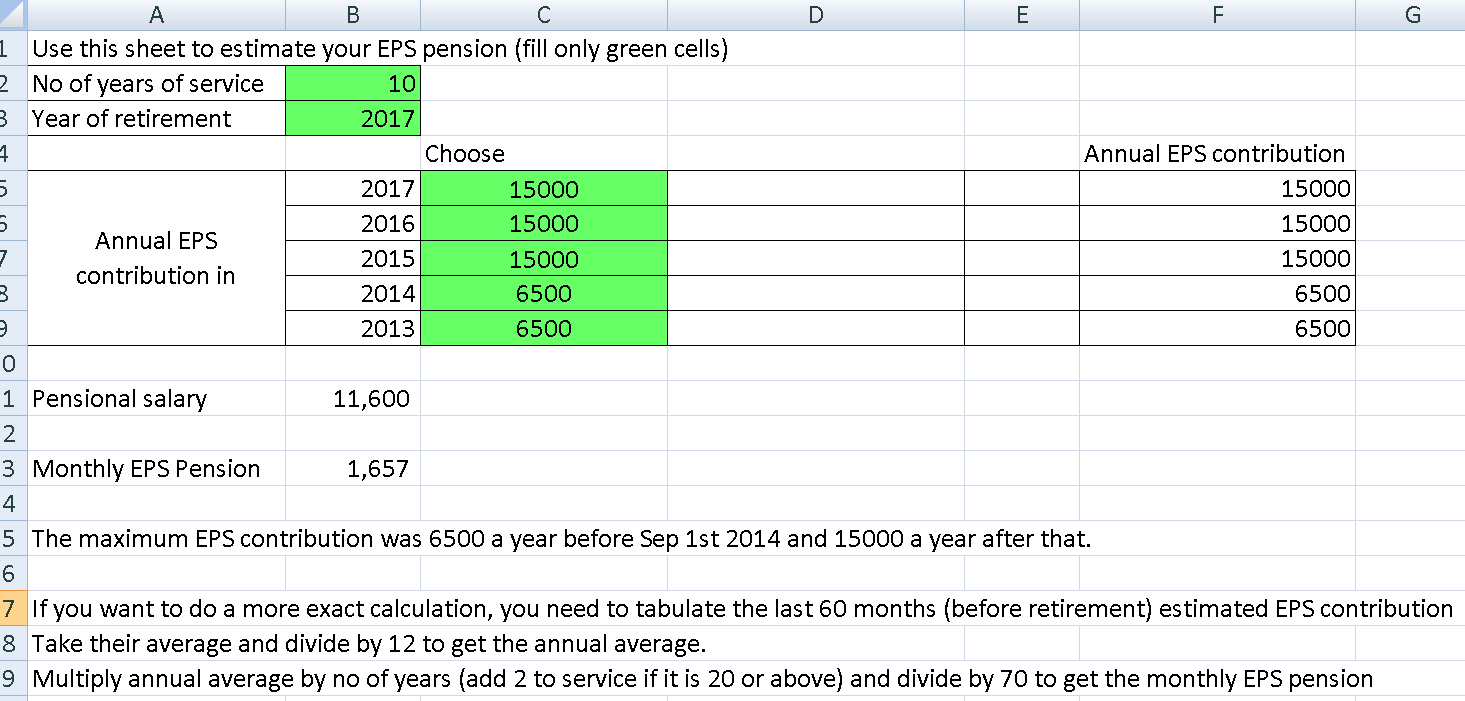

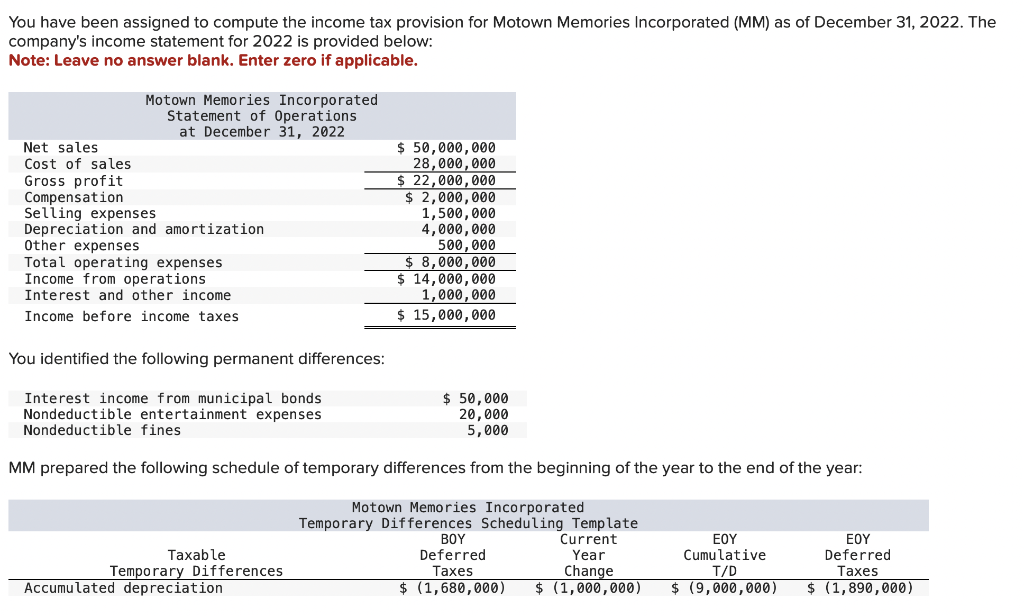

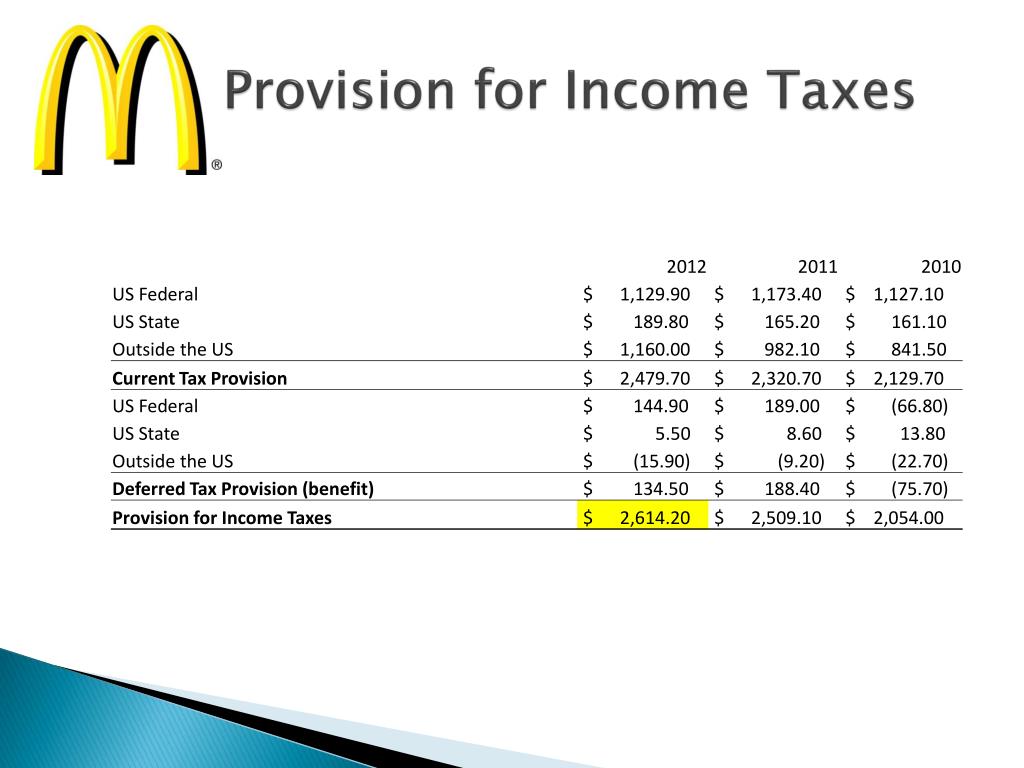

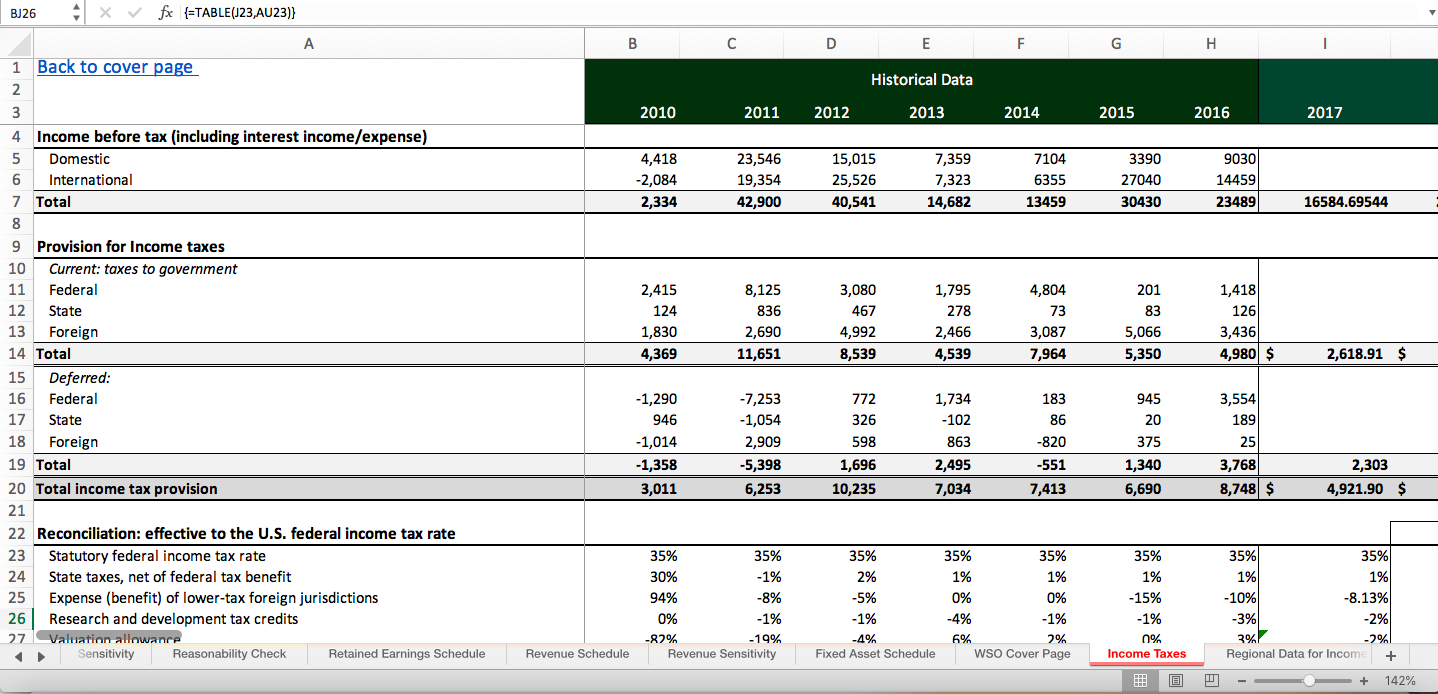

Tax provision template excel. Below you will find the list of all ifrs calculation examples available on ifrscommunity.com, each accompanied by a. 109, accounting for income taxes. If you are currently using an excel spreadsheet to calculate your tax provision, i encourage you to try some of these suggestions to improve your process and to keep it simple.

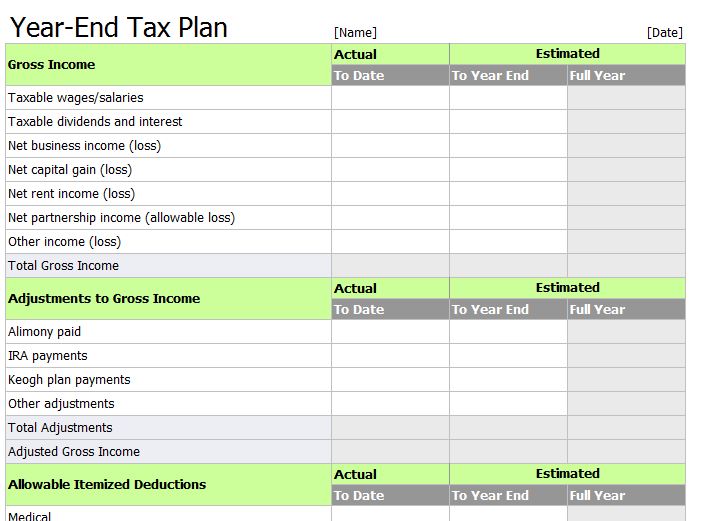

The tax tracker template provides three major tools that alleviate the typical pain points with the 1040 schedules a, c, & d. In this article, we will go through the importance of. This template computes a company's federal income tax provision for financial reporting following sfas no.

[learn how we can help streamline. The following articles from the tax adviser provide examples of how excel can be used in a tax course: The statements of financial position (before tax expenses) and profit or loss are.

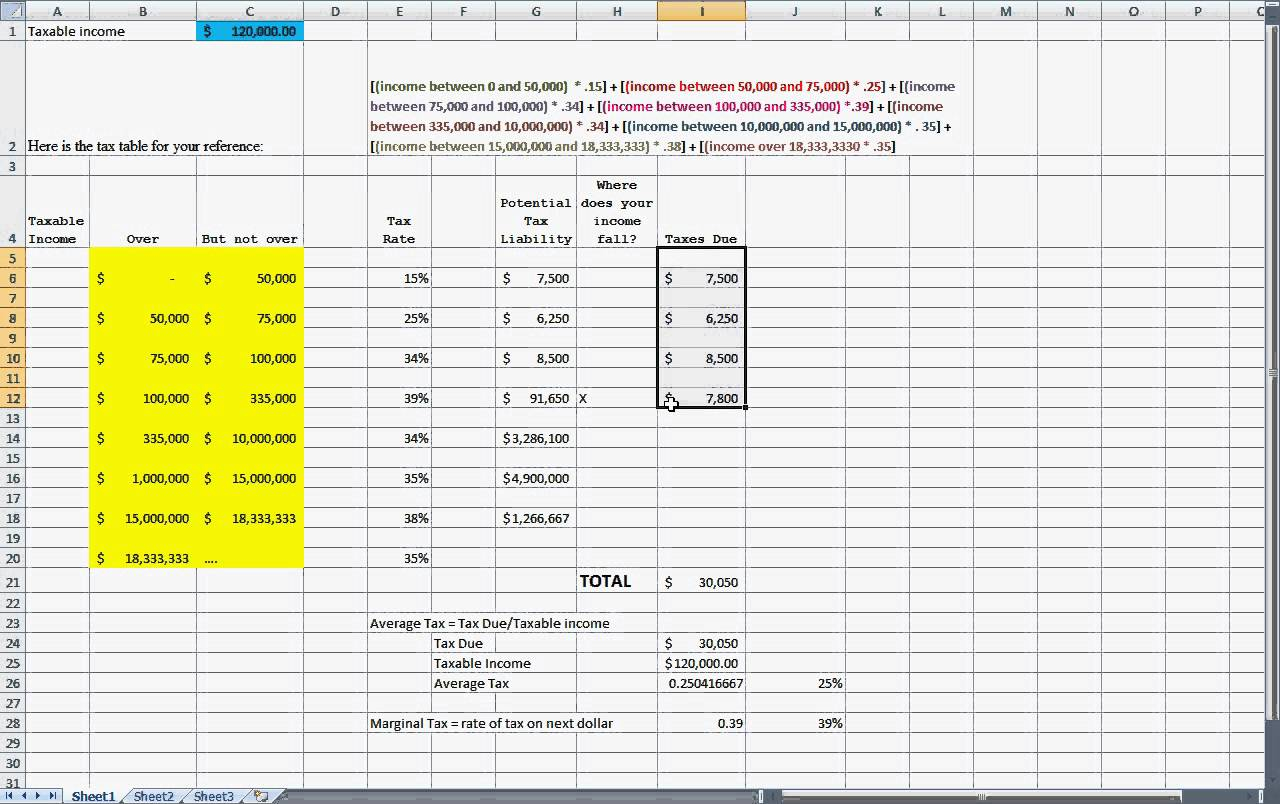

The formula in g5 is:. Prepare your federal income tax return with the help of these free to download and ready to use ready to use federal income tax excel templates. To calculate total income tax based on multiple tax brackets, you can use vlookup and a rate table structured as shown in the example.

Tax rate for 20x5 is 30% (28% in 20x4). Tax provision = (estimated net taxable income x estimated tax rates) + buffer amount while this looks like a simple formula, the actual process of estimating. Evans, et al., using excel in the classroom:

This is a comprehensive course on the deferred income tax provision in which the participants will get the opportunity to learn the rules in ias12 of the ifrs and aspe. Let's start with one of the most comprehensive calculators. This earnings before tax template shows you how to calculate the earnings before tax using line items in the income statement.

These are not deductible for tax purposes. Income tax provision = (net [taxable] income before taxes) x (applicable tax rates) + buffer if that seems simple enough, read on because things can get slightly.