Have A Info About Capital Gains Worksheet Excel

Hopefully it can help others.

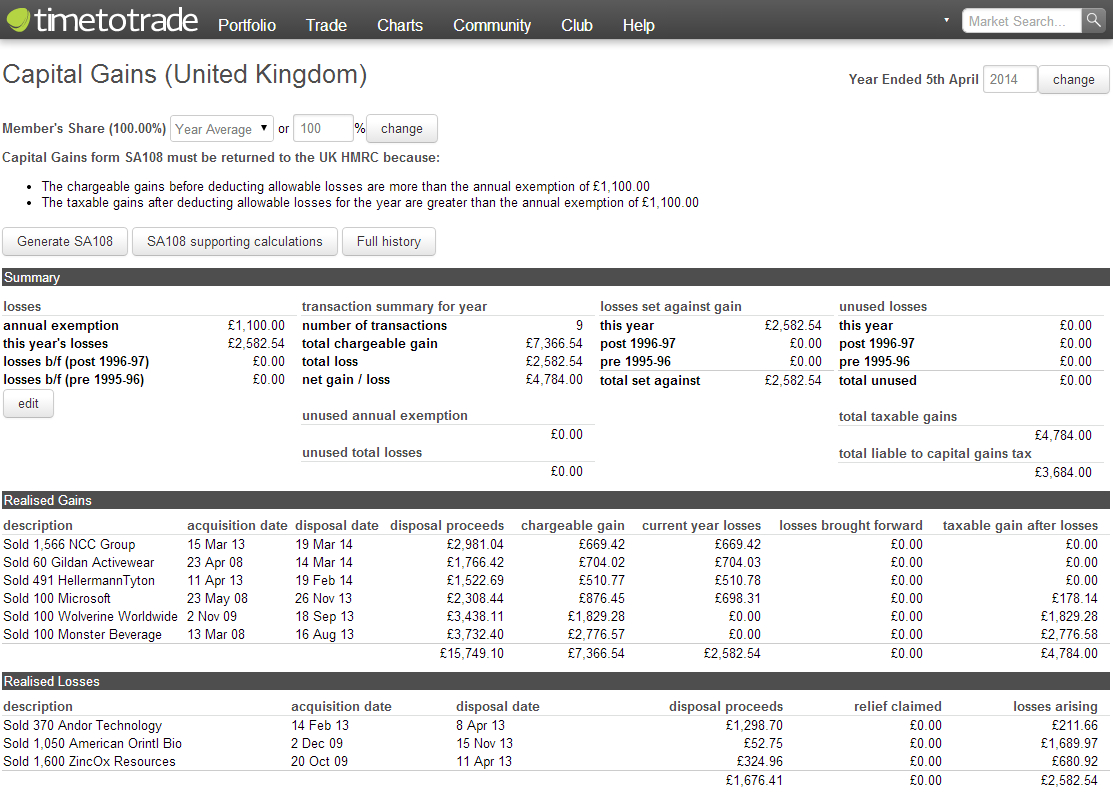

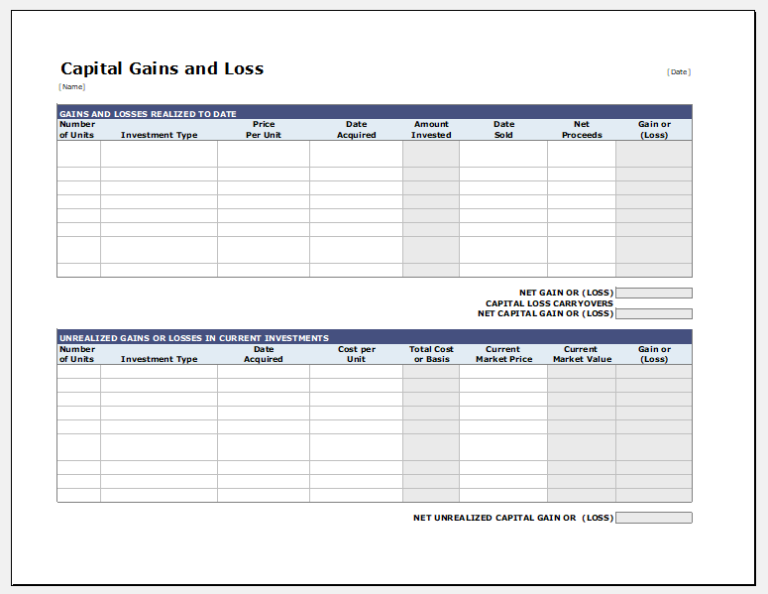

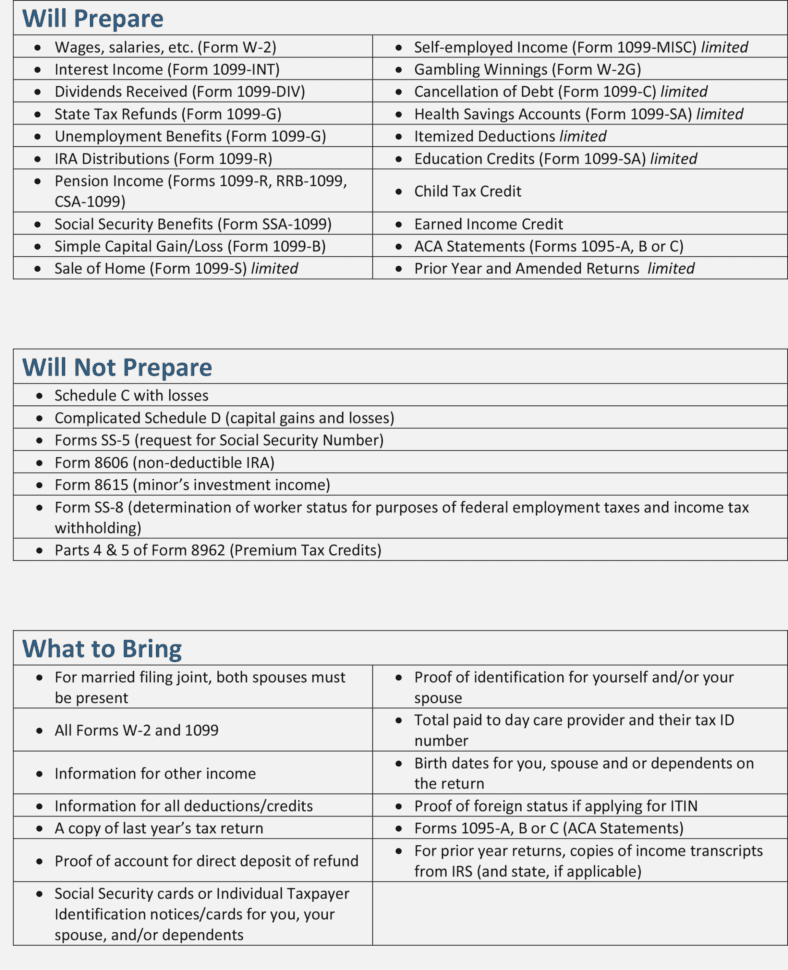

Capital gains worksheet excel. Calculate capital gains when you sell a stock, you owe taxes on the difference between what you paid for the stock and how much you got for the sale. You may be able to use capital losses that exceed this limit in.

14 replies dhirajlal rambhia (seo sai gr. Calculator template worksheet prepared in ms excel is a useful tool that helps in calculating gains and losses. For $50 each a year back.

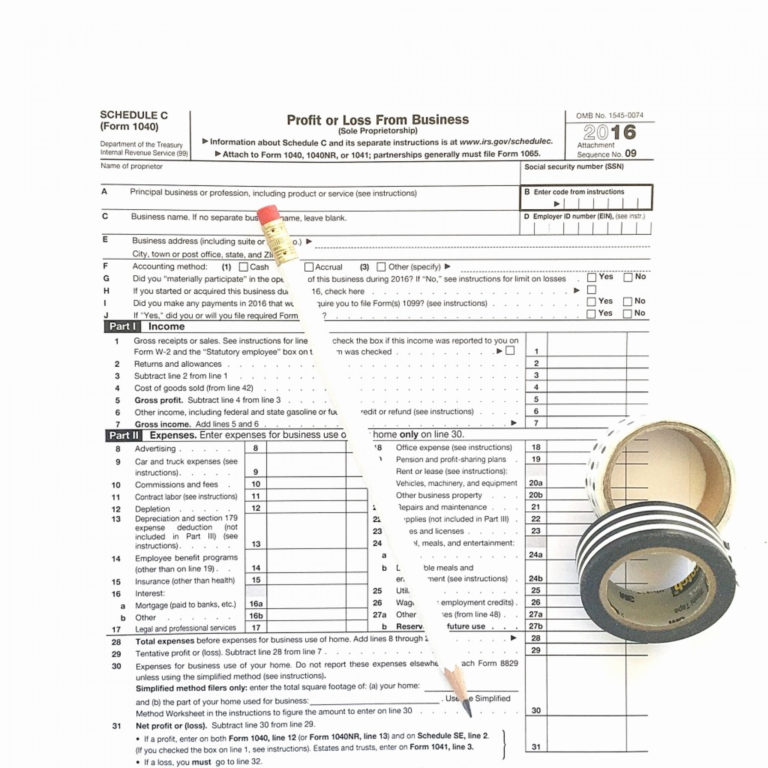

25 replies by anura guruge on february 24, 2022. Tax liability (e + taxable income x marginal tax rates). Use this worksheet to help work out a capital gain or capital loss for a capital gains tax (cgt) asset or cgt event.

You can use a worksheet. Capital gain or capital loss worksheet 2023. I created this excel sheet to help me with my taxation course.

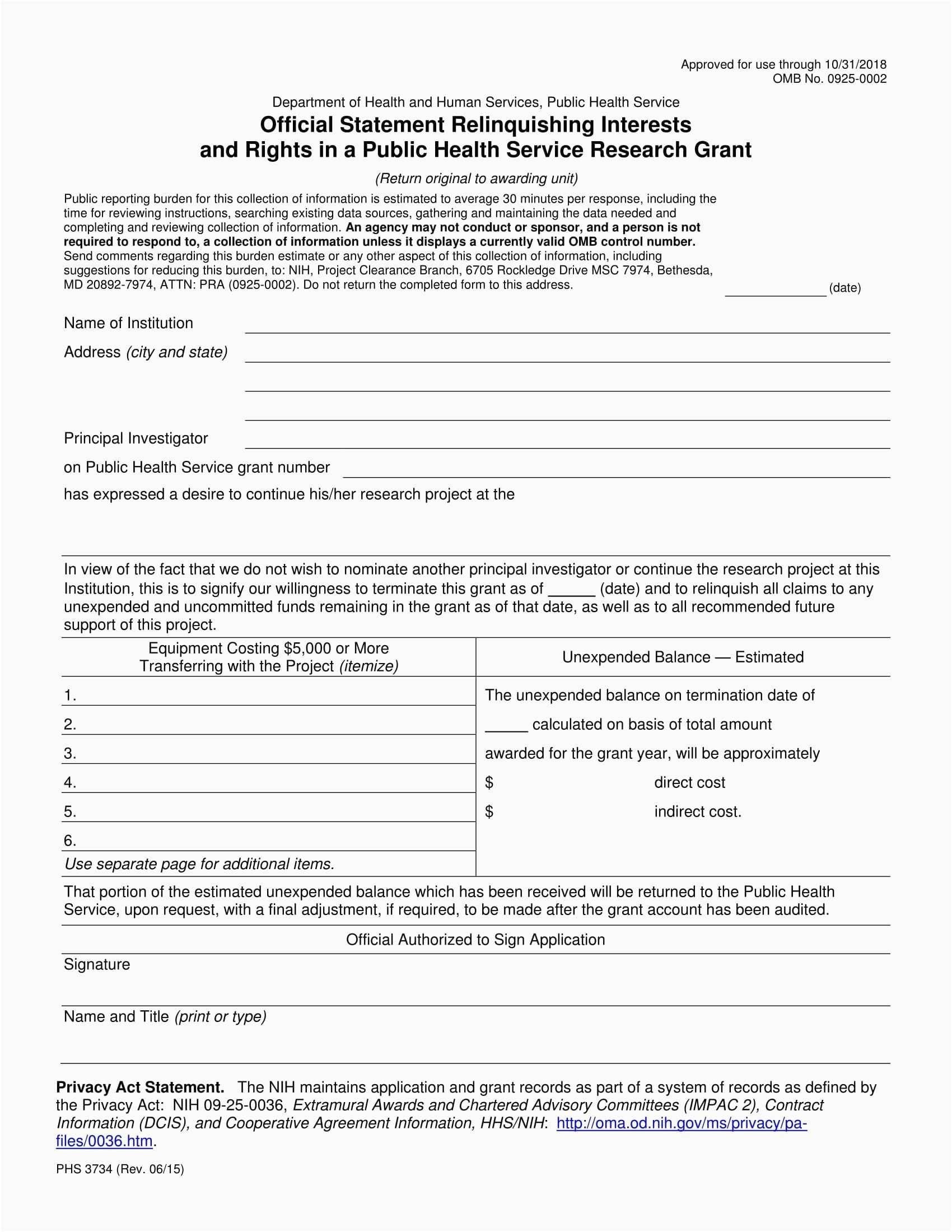

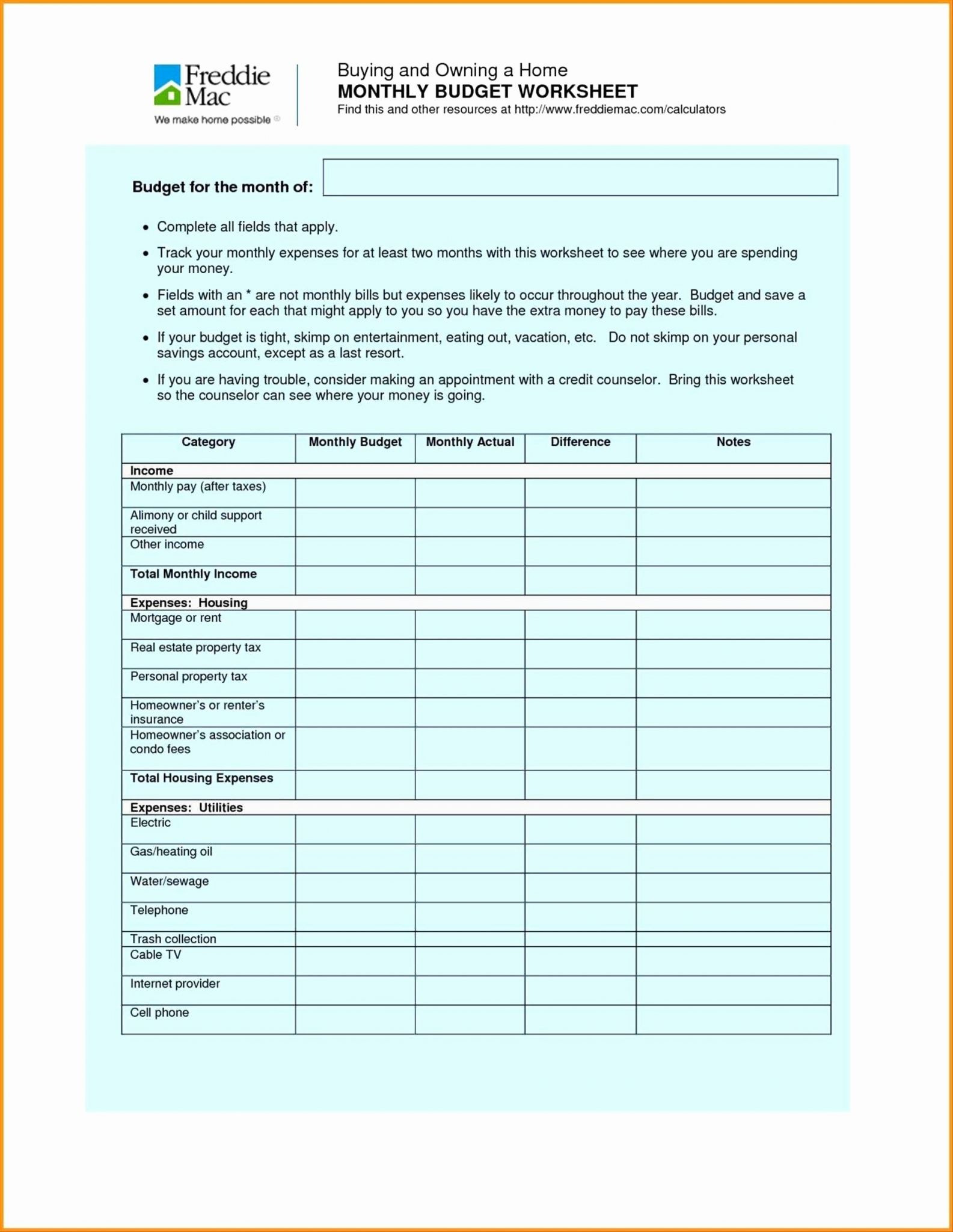

The first qualified tax bracket is the 0% bracket. Capital gains yield (cgy) is the price appreciation on an investment or a security expressed as a percentage. Access practical tools to manage your finances more effectively and achieve your.

Last updated 24 may 2023 print or. Capital gains calculator download excel format. You can deduct capital losses up to the amount of your capital gains plus $3,000 ($1,500 if married filing separately).

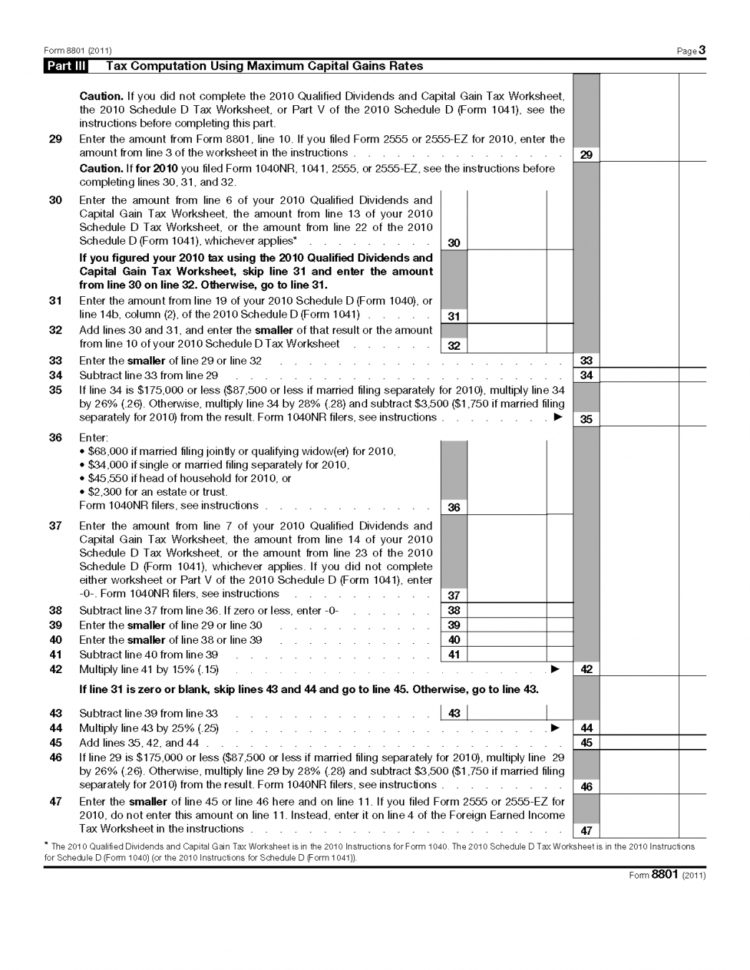

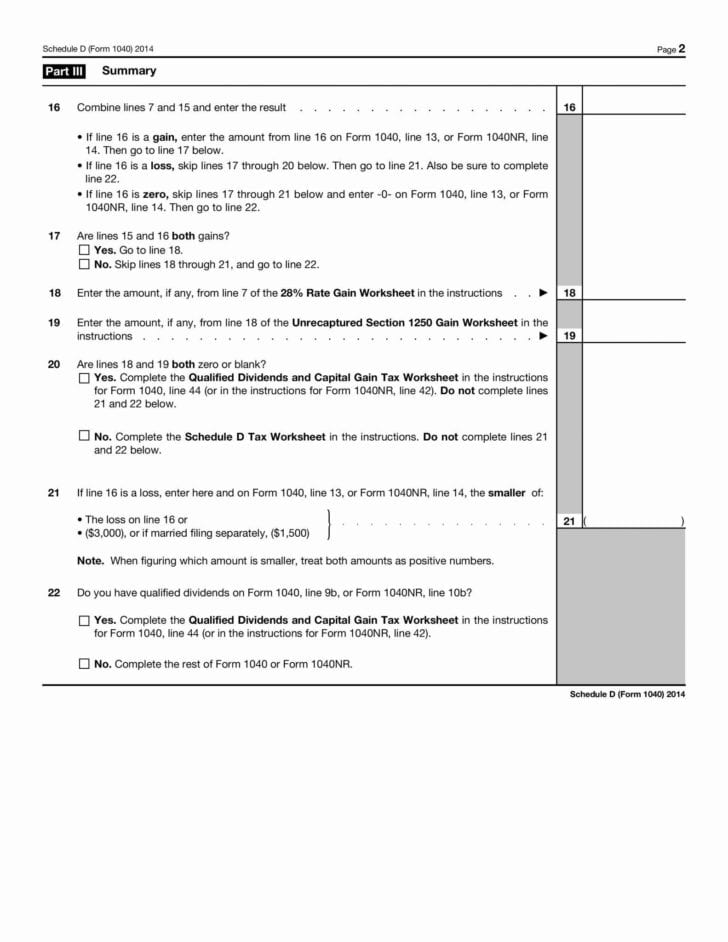

Moreover, this template also helps a user in organizing the. Total profit x 0.5) (assumed cgt discount of 50% if property held for more than 12. Qualified dividends and capital gain tax worksheet— irs 1040 lin.

Keep for your records / v see the instructions for line 16 in the instructions to. Line 9 will either be $0,. Hosp.) (160252 points) replied 10 february 2022 download the calculator.

The formula for calculating capital gains yield is: Streamline your financial processes with rdl accountants' helpful accounting worksheets. Use the capital gain or capital loss worksheet 2023 to work out your capital gain or capital loss for your tax return.